Our dollars will be devalued significantly. This is WHY!

July 12, 2025Hi! I am Jimmy, the team participated in building GoldHub Australia.

In a previous article, we touched on the concept of "The Great Reset," but today I want to dive deeper into the underlying macroeconomic factors that will drive this significant shift. The threat of a monetary reset looms in the horizon, but we haven’t seen crunch time yet. However, it's essential to understand that your cash continues to erode in purchasing power even though the system hasn’t fallen off the cliff. And this trend isn’t about to change. That’s why you might want to pay attention to what we’ll cover today so you can make your preparations.

If you missed out in our previous newsletter, you can see it here: https://www.goldhub.com.au/posts/20250702-beat-the-reset.

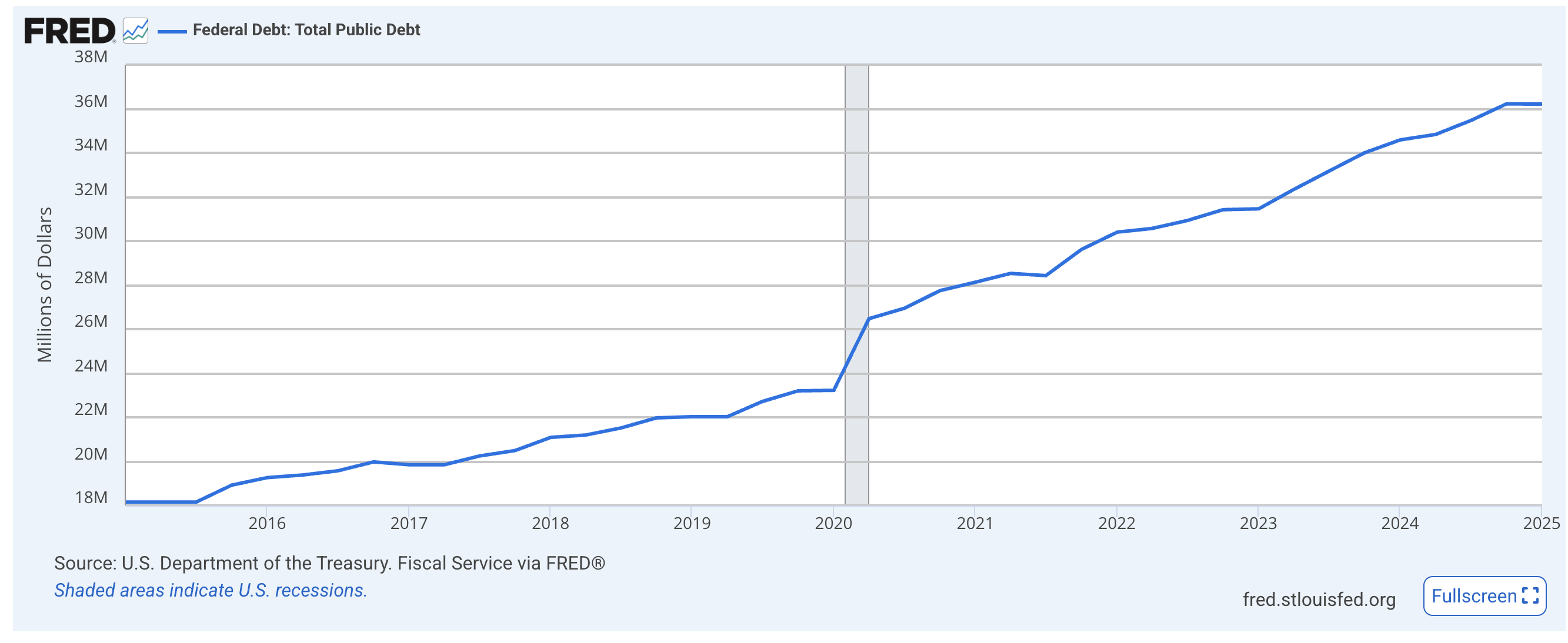

The Alarming Growth of US Public Debt

A staggering reality has unfolded over the past decade: the US government's public debt has more than doubled to an astonishing $36 trillion USD. This relentless accumulation of debt has been building momentum for years, leaving many wondering why it wasn't a pressing concern in the past.

Figure 1: US Federal Government Public Debt (Source: FRED)

What Changed?

The answer lies in the market's growing unease with the current economic landscape. While gold prices have historically been a barometer of market anxiety, they've only recently started to skyrocket - over the last 18 months, to be exact. This sudden surge is a clear signal that investors are increasingly worried about the sustainability of US debt levels.

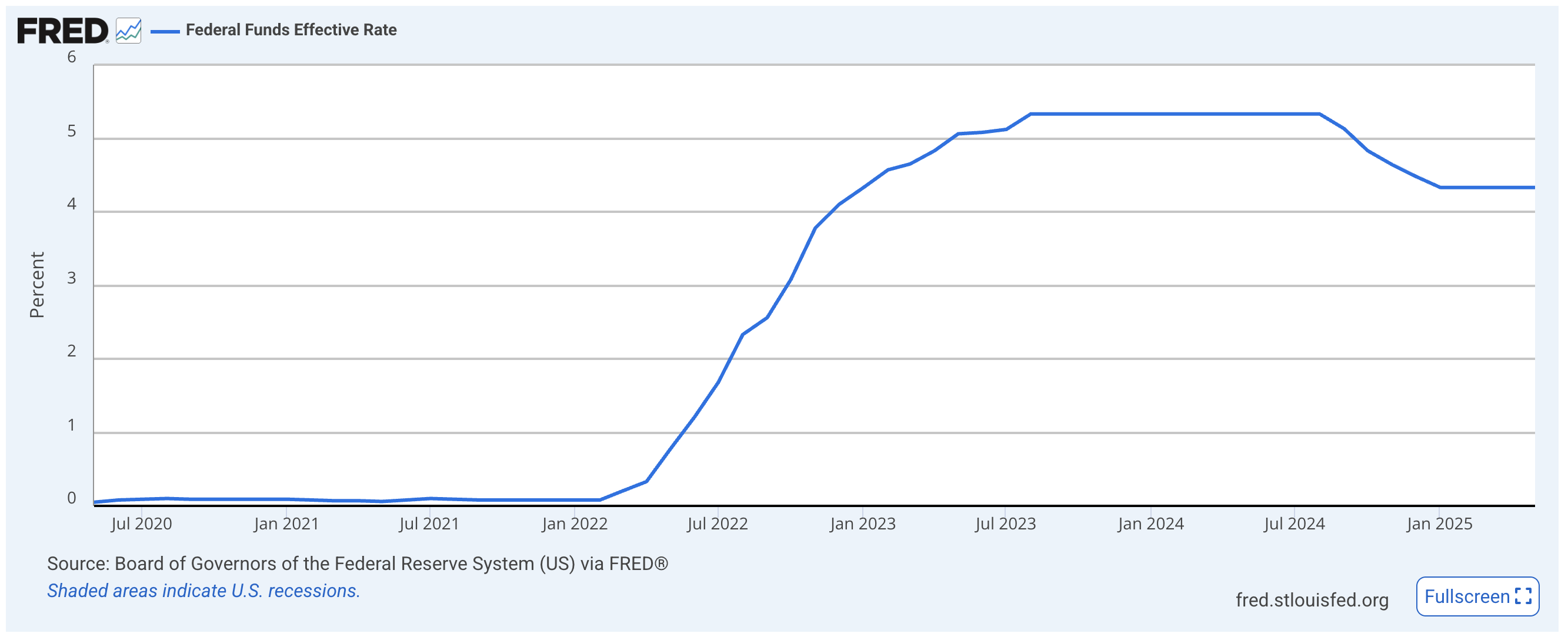

Figure 2: FED Funds Rate (Source: FRED)

The Hidden Debt Bomb: How Higher Interest Rates Are Unleashing a Financial Storm

A ticking time bomb has been quietly building in the shadows of the US economy: the Federal Reserve's (FED) Funds Rate has skyrocketed to unprecedented levels, making it increasingly difficult for the federal government to borrow at affordable rates. For years, the FED's accommodative policies allowed the government to auction low-yield bonds, financing its burgeoning public debt with ease.

The Covid-19 Sugar High

During the pandemic-induced lockdowns, the US government could tap into an unprecedented credit line, borrowing vast sums of money at remarkably low interest rates. As a result, the federal debt ballooned, but the accompanying interest payments were manageable – and could even be offset by new borrowings.

The Interest Rate Trap

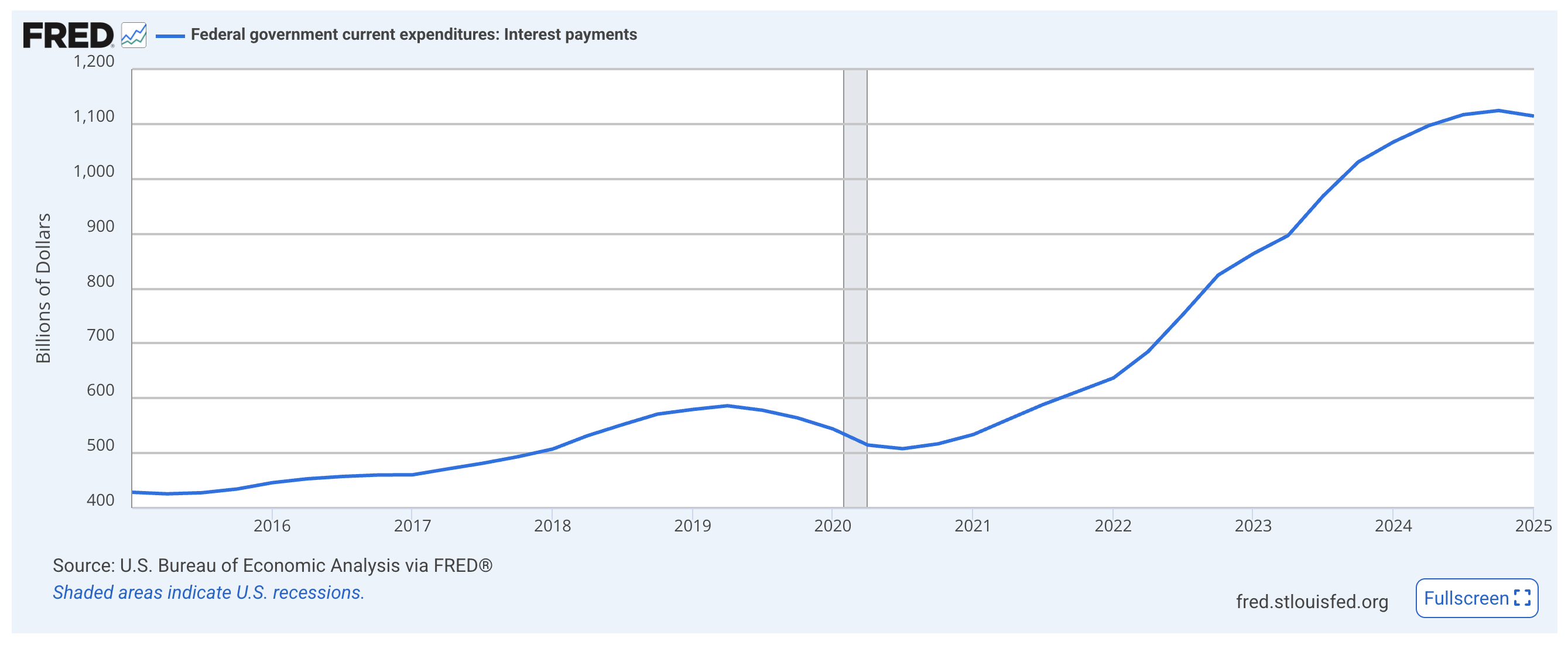

However, those halcyon days are now behind us. The FED's Funds Rate has climbed significantly, and with it, the cost of borrowing for the US government has skyrocketed. What was once a relatively modest $500 billion annual interest payment on federal debt has more than doubled in just two years – to an eye-watering $1 trillion.

The market had been bracing itself for a rate cut, but when it finally realised that the FED was predicting inflationary pressures and therefore will delay the easing conditions, panic set in. We are now bracing for a potentially difficult fiscal environment of higher interest payments, reduced borrowing capacity, and an increasingly fragile financial landscape.

Figure 3: US Federal Government Interest Payment (Source: FRED)

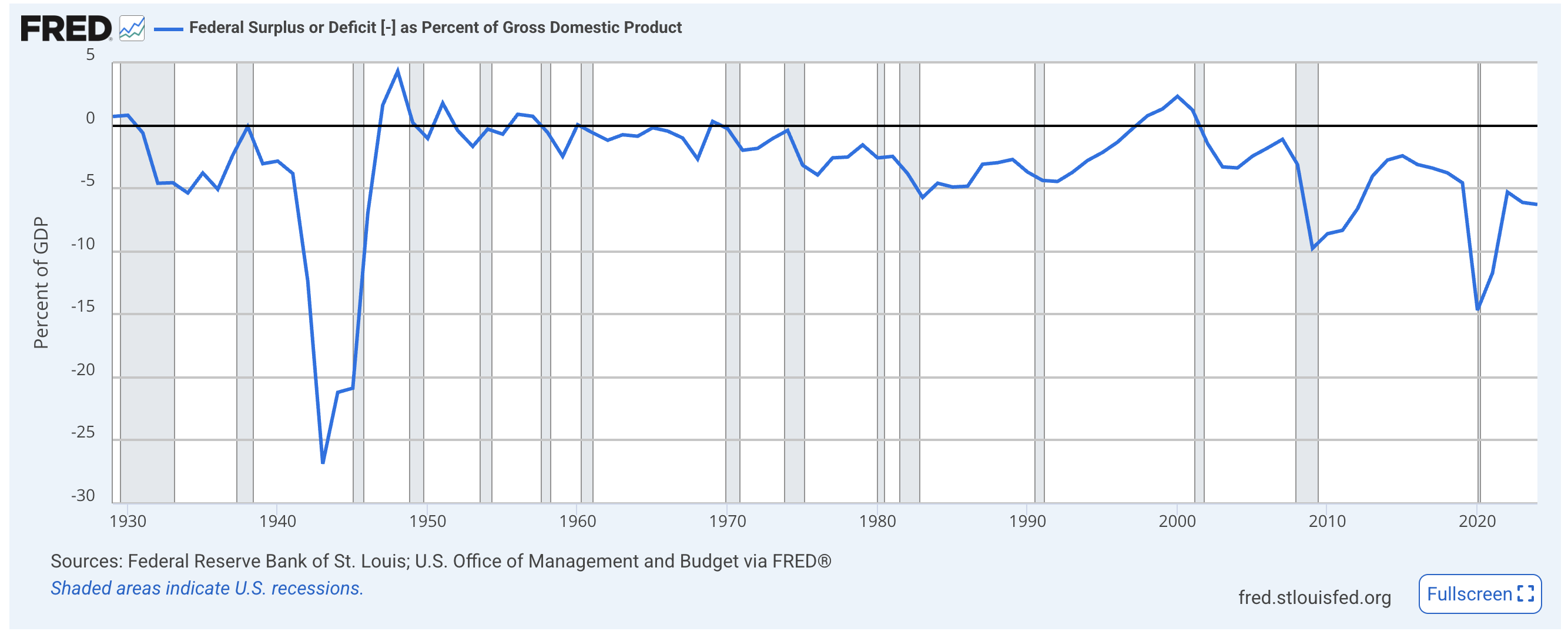

A Decades-Long Deficit

The US Federal Government's chronic budget deficit has been persistent for over 25 years, with no signs of abating. And if we look at the Trump administration's spending plans, it's clear that this trend will only continue – and worsen. The consequence is a perfect storm: an exploding national debt, crippling interest payments, and an increasingly unsustainable financial future.

The high FED Funds Rate would have a devastating impact on the economy, as every dollar spent on interest payments reduces the government's ability to fund essential public services. It's a vicious cycle that threatens to upend the entire economic edifice – and one that demands immediate attention from policymakers.

Figure 4: US Federal Surplus or Deficit (Source: FRED)

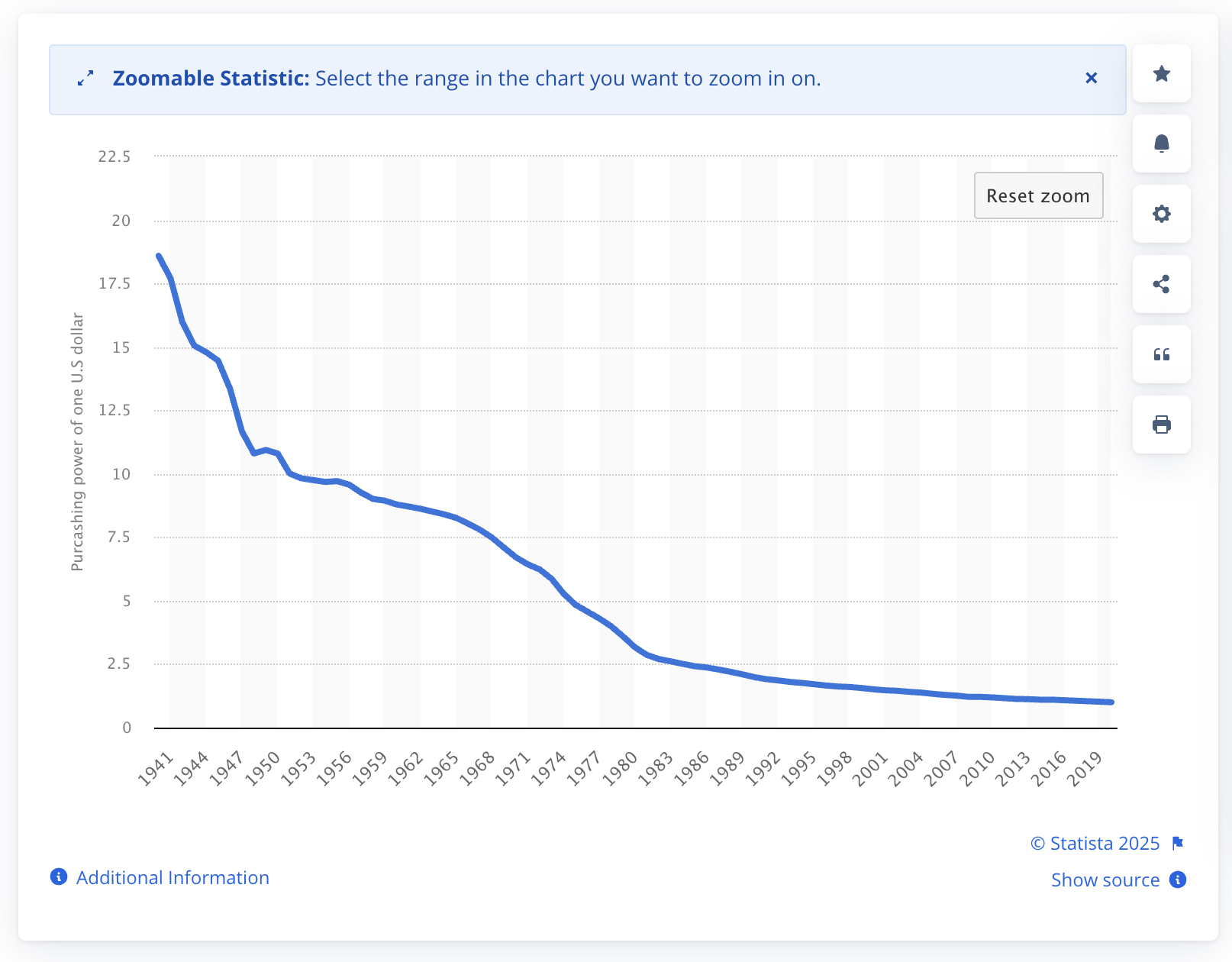

The Historical Precedent: Devaluation of the Dollar

In a striking parallel, the US Federal Government's response to its last major budget deficit in the 1940s provides a stark warning for today's economic landscape. By implementing policies that deliberately devalued the dollar, the government managed to reduce the value of the currency by an astonishing 50% between 1940 and 1950.

Given this historical precedent, it's hardly surprising that experts predict another significant decline in the value of the US dollar. As the government continues to grapple with its massive budget deficit, a devaluation of the dollar could be just around the corner – with far-reaching consequences for investors and savers worldwide.

Figure 5: Devaluation of USD (Source: Statista)

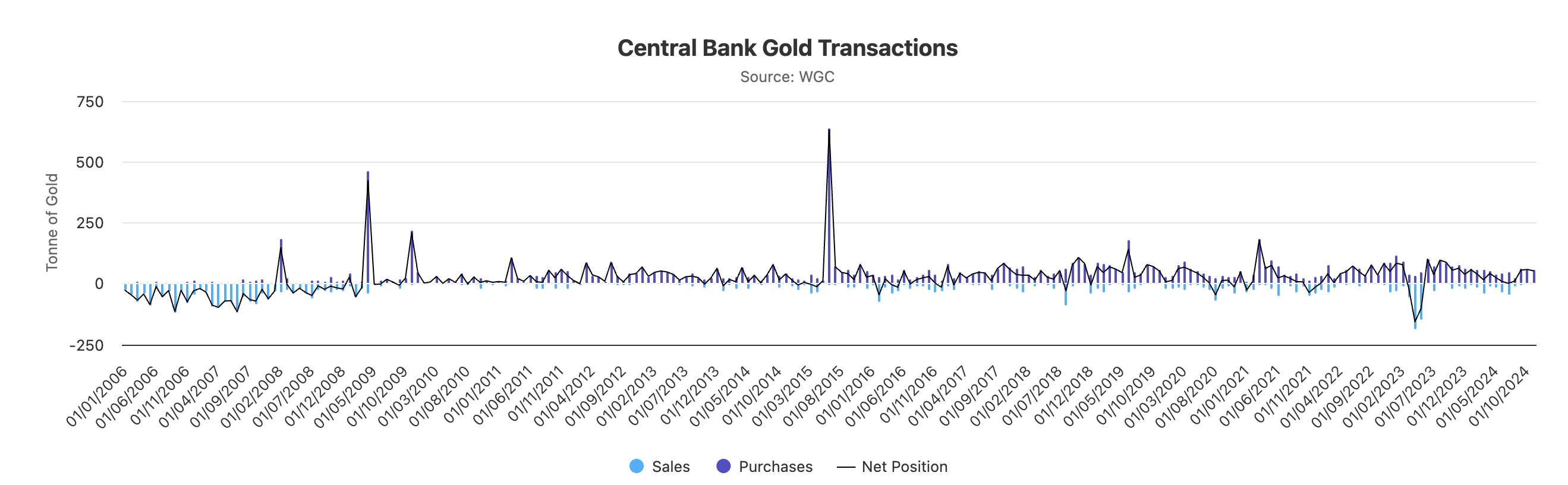

The Shift from USD to Gold: A Sign of Waning Confidence

The United States dollar's status as the global reserve currency has long been a cornerstone of international finance. As such, countries around the world hold large amounts of US dollars and invest in US Treasury bonds, seeking to gain a return on their asset. However, when the real yield on these bonds becomes negative – meaning that the value of the USD is falling faster than the interest earned – central banks begin to reassess their strategy. Since 2008, these institutions have been accumulating gold reserves at an unprecedented pace, indicating a growing distrust in the value of the dollar.

Gold: The Store of Value Asset

Throughout history, gold has served as a trusted store of value asset, providing a hedge against inflation and currency devaluation. With its durability, rarity, and limited supply, gold has maintained its allure for over 5,000 years. As central banks increasingly turn to gold to protect their purchasing power, it becomes clear that the US dollar's status is no longer as secure as once thought.

Figure 6: Central Bank Gold Transactions (Source: World Gold Council)

GoldHub Australia Macro's Expert Insights into FED Funds Rate and Beyond

As we've discussed at length, the Federal Reserve's (FED) Funds Rate plays a pivotal role in shaping the global economy. By influencing the cost of borrowing for the world's reserve currency – the USD – the FED's decisions have far-reaching consequences for international trade and finance.

The FED operates under a dual mandate: to maintain low and stable inflation, typically around 2%, and to promote maximum employment. In our macro economics section at GoldHub Australia, we take these objectives into account when forecasting the FED's Funds Rate trajectory.

To provide accurate predictions, our analysis incorporates several key indicators:

- CPI (Consumer Price Index): We monitor CPI levels and trends to assess inflationary pressures.

- US Unemployment Rate: The strength of the labor market is a crucial factor in shaping monetary policy decisions.

- Recession Indicator: This indicator helps us gauge the risk of an economic downturn, which would necessitate changes in interest rates.

By combining these insights with our proprietary models and analysis, we provide clients with informed forecasts on where the FED's Funds Rate might go next. This enables them to make data-driven decisions about their investments, ensuring they remain ahead of the curve in today's fast-paced global economy.

You can check out GoldHub Australia latest macroeconomy analysis here.

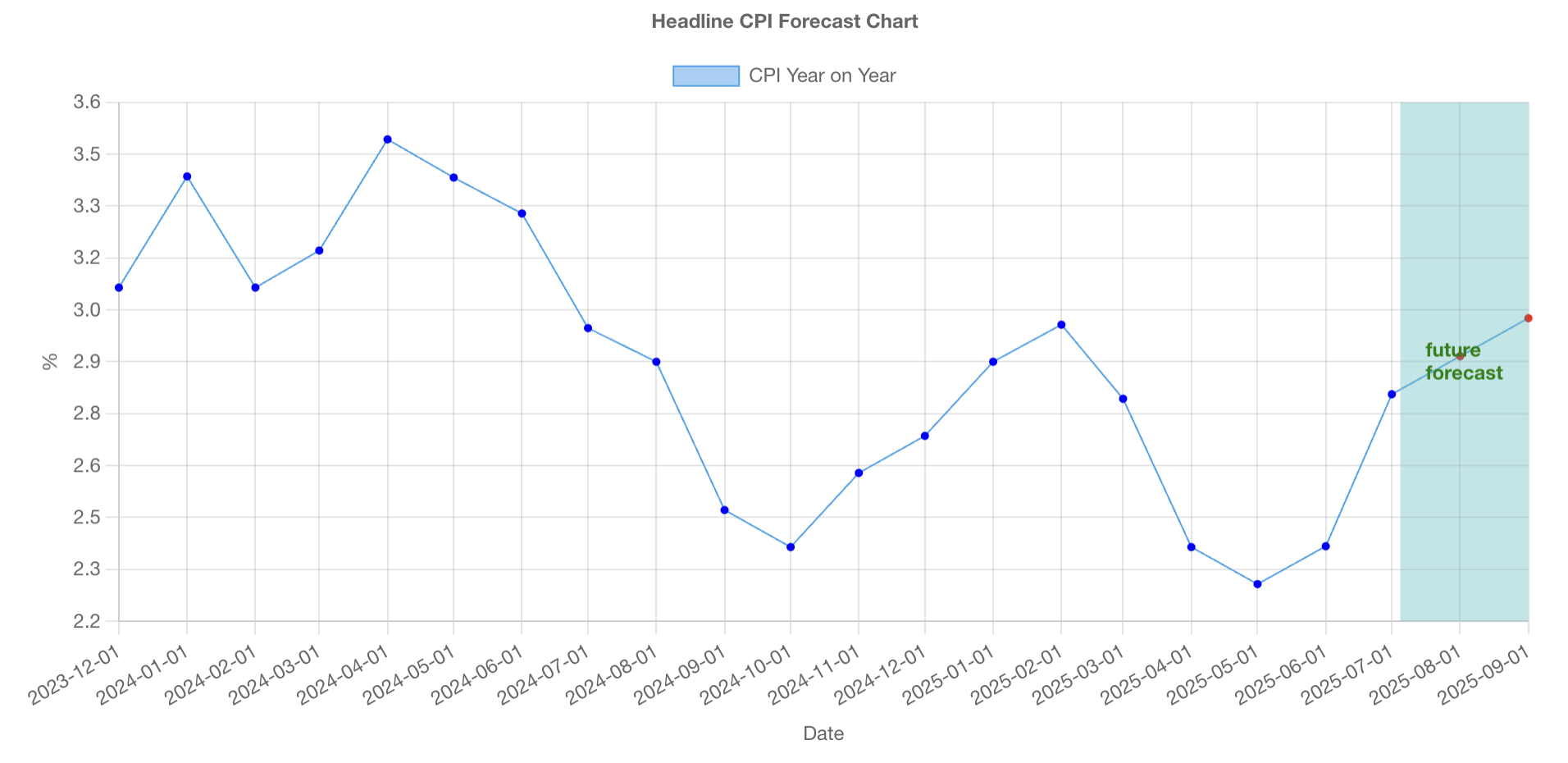

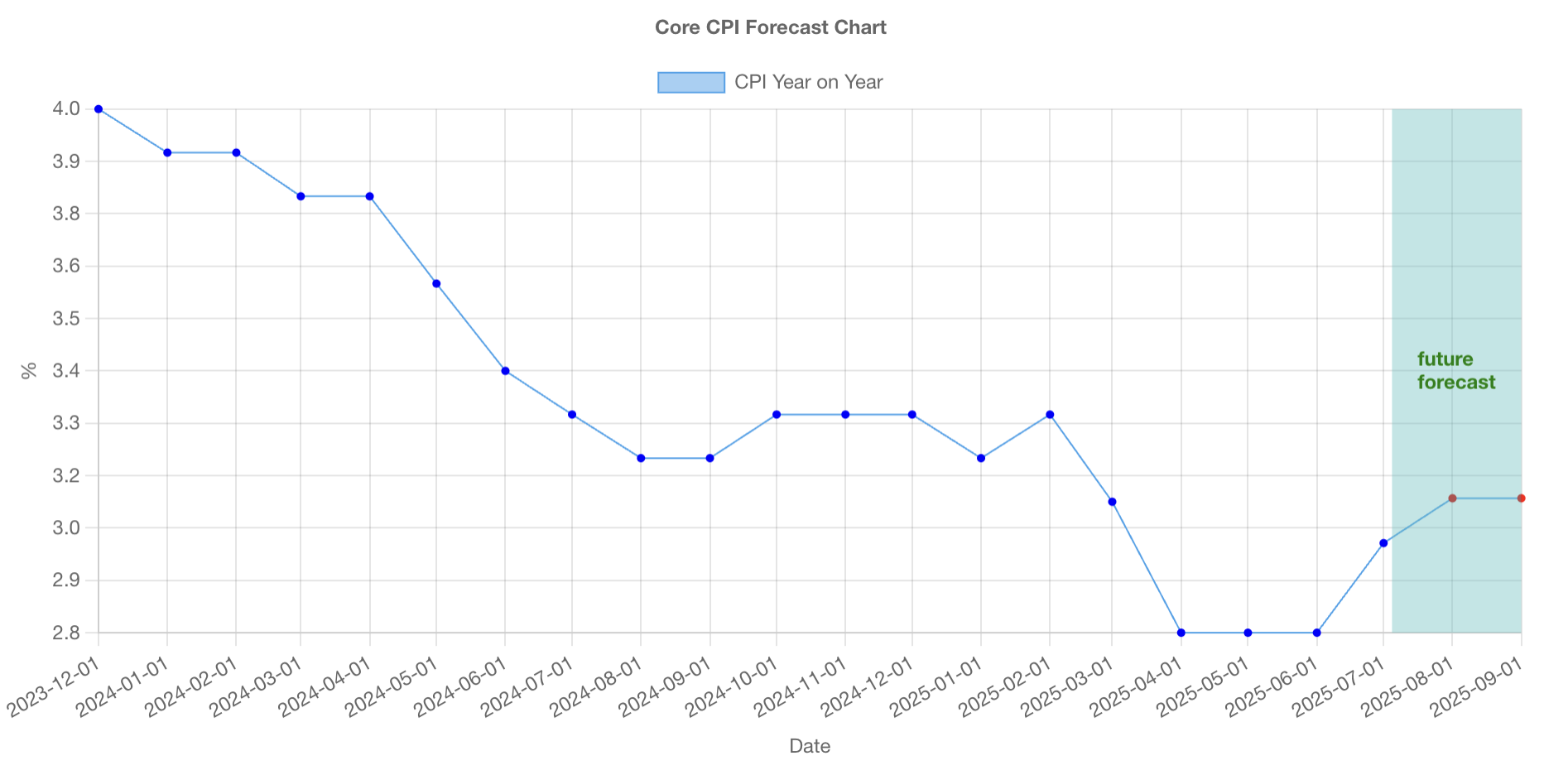

CPI Predictions: A Mixed Bag

The latest forecast from GoldHub Australia Macro suggests that:

- Headline CPI will continue to rise, contrary to expectations of a slowdown.

- Core CPI is expected to stall, indicating a lack of pressure on prices.

This mixed bag of signals may not bode well for the Federal Reserve (FED), which is actively working to keep inflation in check. The FED's primary goal is to maintain low and stable inflation rates, as high inflation can erode purchasing power and lead to economic instability.

The rising headline CPI suggests that prices are continuing to increase, potentially indicating a sustained period of inflationary pressures. In contrast, the stalling core CPI may indicate that underlying price pressures are easing, which could be a positive sign for the economy.

However, the FED's primary concern is the overall inflation rate, and the mixed signals from the CPI predictions may require further analysis to fully understand their implications.

Figure 7: Headline CPI Forecast (Source: GoldHub Australia)

Figure 8: Core CPI Forecast (Source: GoldHub Australia)

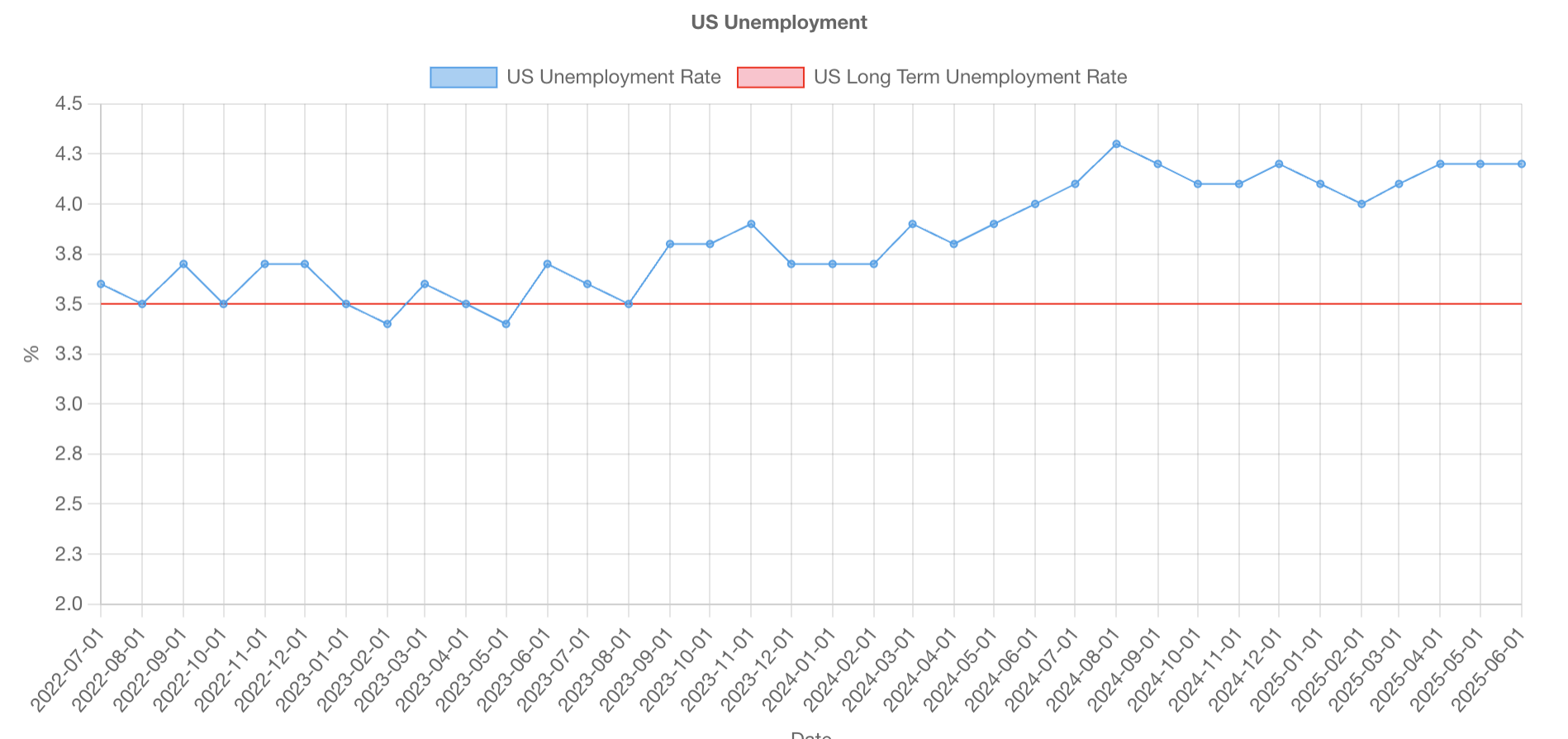

Unemployment Rate: A Cause for Concern

The unemployment data suggests a slow rise in joblessness, which may not be alarming at first glance. However, it does indicate a need for a lower FED funds rate to support the economy.

Figure 9: US Unemployment Rate (Source: GoldHub Australia)

Recession Indicator: A Warning Sign

Historically, the 2 Year and 10 Yield bond spread has been a reliable indicator of an impending recession. With this spread turning negative and then positive again, it is signal the potential that a recession may be on the horizon.

Figure 10: 2 Year / 10 Year Bond Yield Spread (Source: GoldHub Australia)

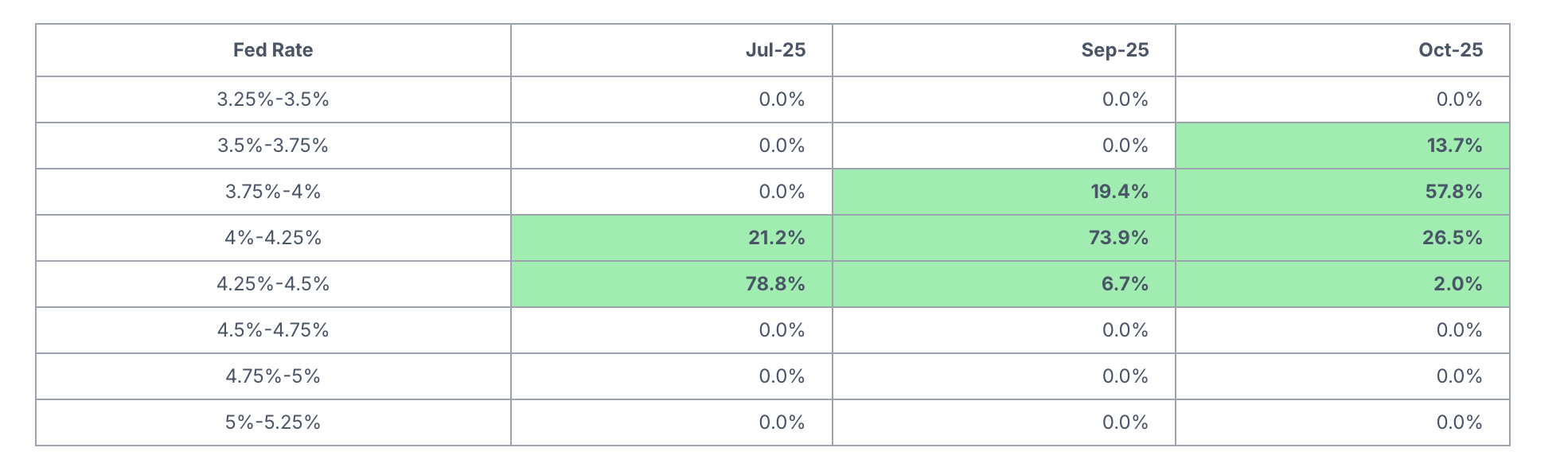

Fed Rate Prediction: A Potential Rate Cut, Or Two

Given the potential weakness in the economy and employment market, it's likely that we'll see at least one 25 basis point rate cut from now to September, and possibly two such cuts by October.

Figure 11: Fed Rate Prediction (Source: GoldHub Australia)

Gold Traders: A Neutral Outlook

After 12 months of explosive growth, gold has reached a critical plateau near US$3,500. With financial risk levels having decreased in recent months, traders are now looking out for signs of a minor correction - but this time, it could be a welcome relief rather than a cause for alarm. Meanwhile, we see a possible dip in real yields due to lower FED funds rates and higher CPI numbers, which could actually provide support to the gold price.

By breaking down the data into smaller, more manageable chunks, we can gain a better understanding of the complex signals being sent by the economy. Whether you're a seasoned investor or just starting out, staying informed and adaptable is key to navigating these challenging economic times.

Try out GoldHub Australia Macro module!

If you like our analysis, you can see the latest macroeconomy analysis here.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.