Beat The Reset

At the Gold Coast conference that took place in April, Brian had the pleasure of interviewing Tim Manger, director of "Beat the Reset." Tim is the author of "Things We Were Never Told About Money" and "The Great Asset Shift," and he has been sharing valuable insights on the importance of real assets versus unreliable fiat assets.

So what is the Reset?

Our current financial system operates via a fiat currency system, which allows governments, banks, and other entities to control the value of money. However, this system has its limitations, and at times, it requires a reset to function properly.

In 1933, the United States experienced a widespread banking crisis characterised by numerous bank runs due to fear and loss of confidence in the financial system. This led to a surge in withdrawals as depositors scrambled to protect their money before banks collapsed. In response, US President Franklin D. Roosevelt signed the "Emergency Banking Act", closing many banks across the country for various periods of time.

This was followed by Executive Order 6102, which required citizens to surrender their gold, and a suspension of the gold standard. These actions aimed to stabilise the banking system and prevent further gold outflows during the Great Depression.

To boost commoners' confidence in the banks, the US introduced the Federal Deposit Insurance Corporation (FDIC), which provides deposit insurance for depositors in US banks, protecting their deposits up to $250,000 per depositor, per insured bank.

In 1934, the Gold Reserve Act of 1934 was passed, consolidating the nation's gold reserves under the Treasury and making it a criminal offense for US citizens to own or trade gold anywhere in the world. This action aimed to support the dollar as the primary monetary standard and to combat gold hoarding (as was claimed but likely the excuse to legitimise the passing of this Act) during the Great Depression, as well as recapitalise banks and prevent further bank runs.

Throughout history, financial resets have occurred, and this is just one of the many examples.

What does that relate to me?

Since the global financial crisis of 2008, governments have printed a significant amount of money through multiple rounds of quantitative easing (QEs) to devalue their currency. In 2020, during the COVID-19 pandemic, there was an even larger attempt to inject a huge amount of cash into the economy. However, with more cash chasing fewer goods, the value of money has decreased over time.

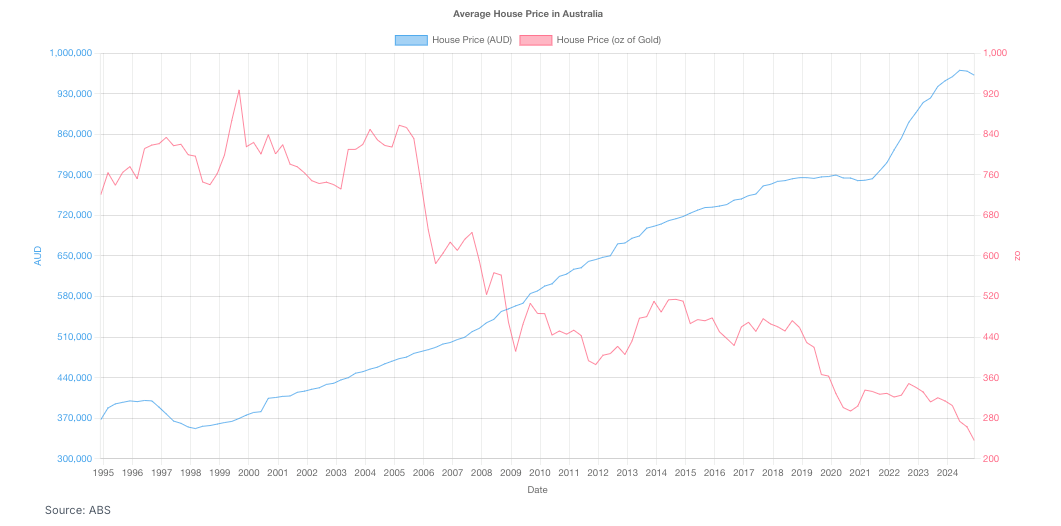

When we see house prices in Sydney rising to new highs over the last 30 years, it's important to consider this in gold terms. Using GoldHub's calculator, we can see that despite the medium Sydney house price increasing, it's actually getting cheaper when measured in gold terms. This means that while the value of cash in our banks may be going up, the things we buy with that cash are actually losing value over time.

Figure 1: Average House Price in Australia (Source: GoldHub Australia)

The World Economic Forum (WEF) has proposed an economic recovery plan called "The Great Reset" after COVID-19. While some may believe that these efforts will improve the lives of ordinary people like you and me, I can't help but wonder how governments will deal with their growing debt levels. In my opinion, the easiest way to handle this issue is to simply revalue the cash in our banks or, as some call it, "inflate the debt away." It certainly looks like so to me with inflation rampaging in the last few years!

So how can we protect ourselves?

I mentioned earlier how the US government seized the ordinary people's gold to recapitalise the banking system. However, this move highlights the importance of keeping some gold for personal wealth protection, rather than stop you from doing so. Having some physical gold is a prudent decision. The alternative is to buy an ETF, such as Perth Mint Gold ETF (ticker: PMGold). While other ETFs for gold exists, PMGOLD offers an additional guarantee by the Government of Western Australia, which no other ETFs provide. You can also request the conversion of your PMGOLD units into physical gold holdings in a Perth Mint Depository account, or delivered to you in a secure location.

Other ways to capitalise on gold's superior wealth preservation and creation capabilities is to invest in gold mining companies. They can prove lucrative though with significantly higher risks. We mentioned at the start of the newsletters how Evolution Mining, one of the largest gold producers on the ASX, performed well, having more than doubled its price in the past year. This is better than gold's gains which increased by around 30% during the same period.

Figure 1: Average House Price in Australia (Source: GoldHub Australia)

To enhance your performance in investing in gold mining companies, consider trialling our GoldHub data service where we provide key data for individual ASX gold mining producers https://www.goldhub.com.au/analysis. You can easily view the key indicators that impact the trend of gold mining producers. We also offer macro indicators to help you monitor the key drivers of performance for gold mining companies.