Gold Stabilises Above US$5,000/oz, Silver Rebounds Sharply

February 11, 2026Welcome back ladies and gentlemen, once again, to the Australian Gold Mid-Weekly Review! Every Wednesday, we bring you the mid-weekly series to keep your investing game up-to-date with the latest movements across precious metals and mining markets.

Well, after last week's slump, gold appears to have found its footing again. The yellow metal has stabilised in the US$5,000/oz region for the past two days and is currently trading at US$5,067/oz. Weak U.S retail spending data has reinforced expectations of additional rate cuts moving into the year ahead, providing renewed support for gold and helping it regain composure above the US$5,000 mark.

Meanwhile, silver continues to follow suit with gold. After trading at as low as US$64/oz last week, the metal has staged an impressive rebound and is now trading at US$83/oz. The recovery reflects silver's characteristic volatility, but also its tendency to amplify gold's directional moves during periods of renewed investor confidence.

Oil, on the other hand, remains largely rangebound at nearly US$65/bbl. Ongoing geopolitical tensions between the U.S and Iran continue to underpin prices, preventing a deeper pullback, yet the market has not shown enough conviction to break meaningfully higher.

Back home, the ASX-All Ordinaries Gold Index has managed to find its ground again. The index is now nearing the 21,000 point mark, currently trading at 20,918.66 points. After last week's turbulence, the recovery signals a gradual return of confidence into Australian gold equities as bullion stabilises.

Evolution Mining Strengthens Growth Pipeline

In other news, Evolution Mining has strengthened its relationship with Triple Flag International and obtained board clearance for a number of high-return growth initiatives, laying the groundwork for increased copper and gold production at Northparkes.

With a $545 million capital investment, Evolution will build the E22 block cave at Northparkes, creating a low-cost, long-term underground operation that should yield a return of 28% at base metal prices and 38% at upside values.

Evolution Mining chief executive officer and managing director Lawrie Conway said: "The investments announced today are expected to deliver returns in the range of 23 per cent to 48 per cent, which is higher than our current portfolio's average return of 18 per cent."

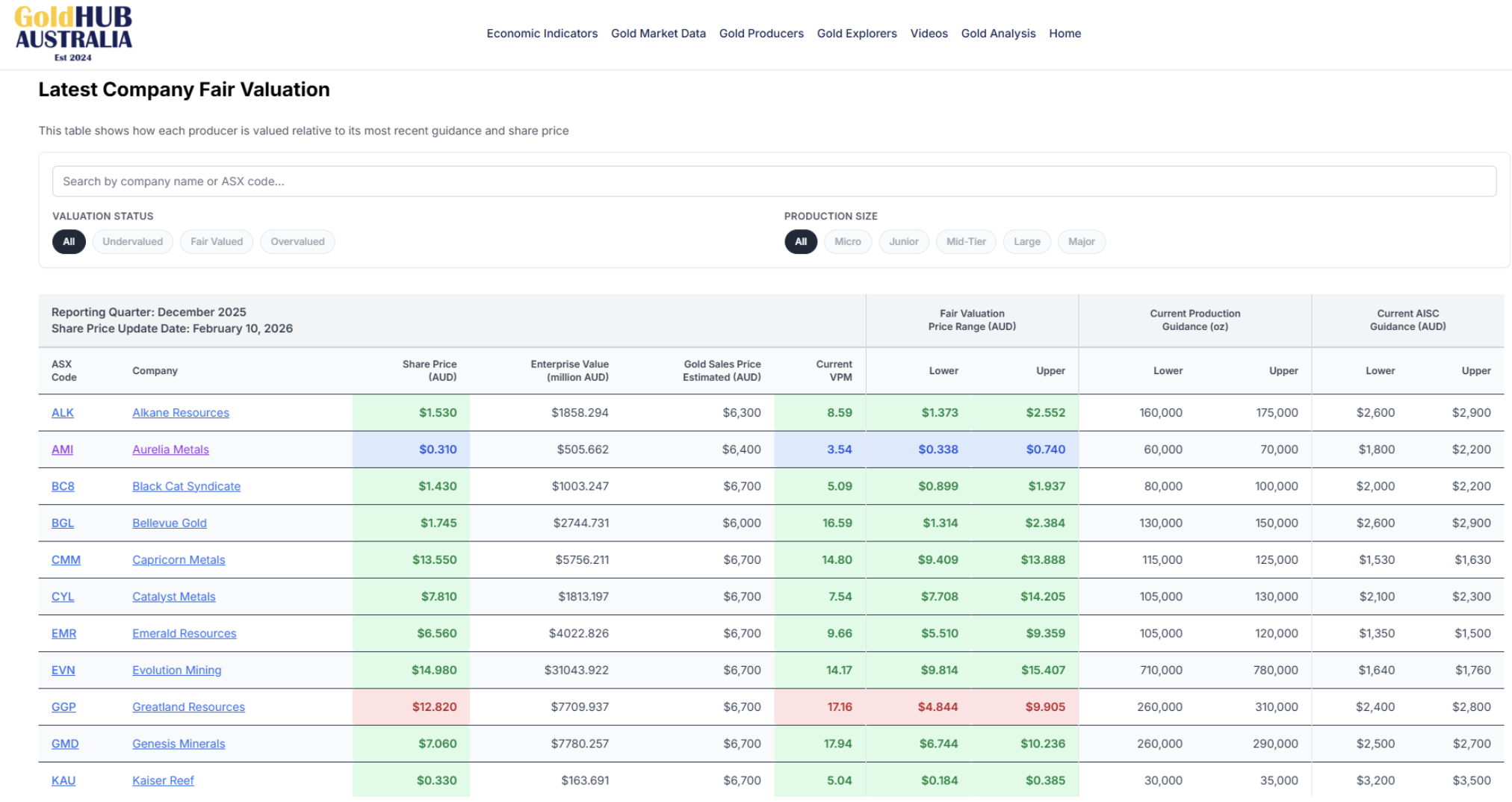

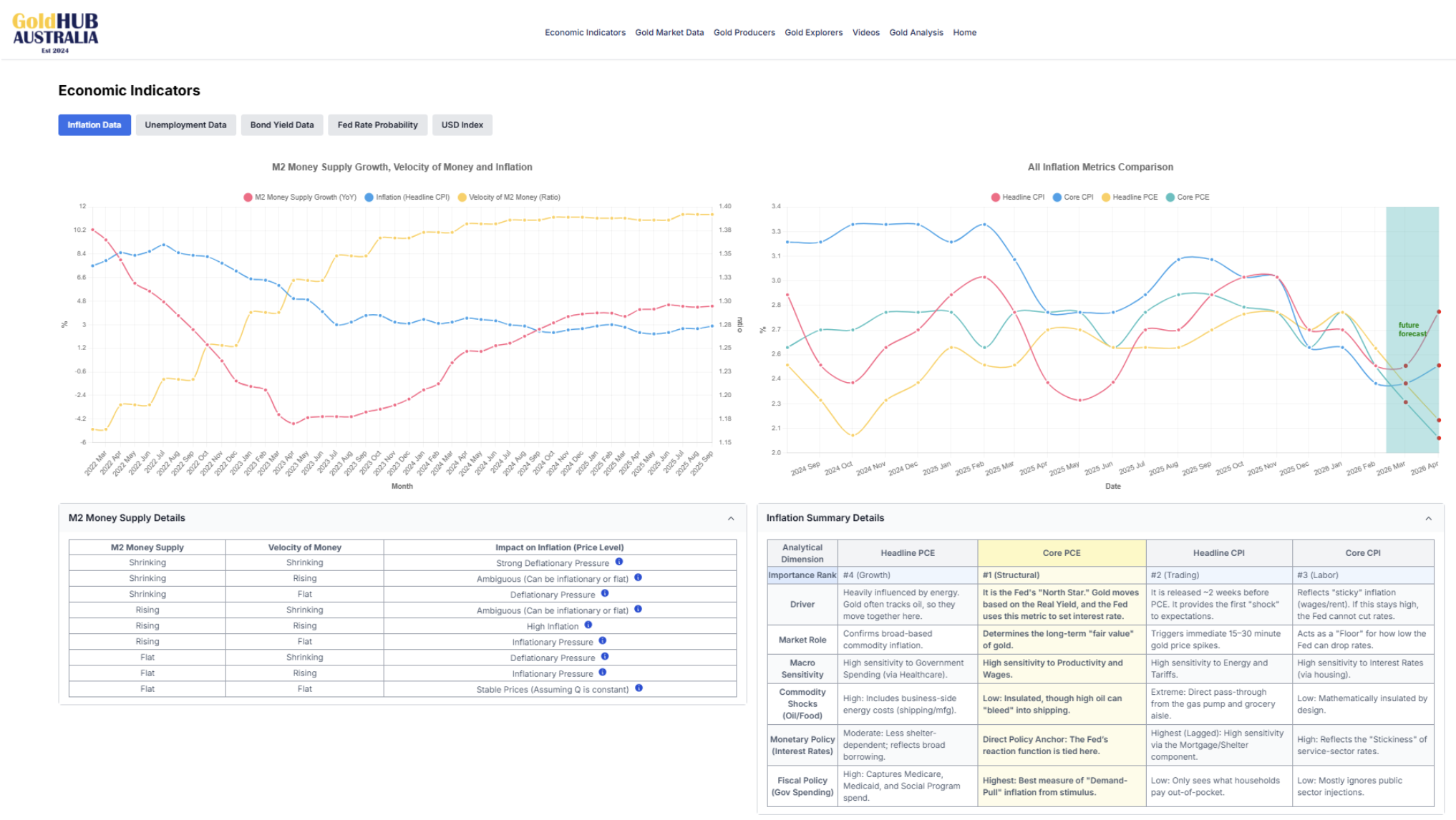

GoldHub Australia Platform Updates

And finally, we are pleased to share that we have made significant improvements to the GoldHub Australia website to make your investment journey even greater. The platform now offers a more intuitive, user-friendly experience, coupled with deeper insights into your favourite precious metals and mining companies. You can now access exclusive insights into gold miners, explorers and developers' valuations, alongside a more user-friendly, educational macroeconomic database designed to empower you to make more informed investment decisions.

Figure 1: GoldHub Australia Fair Valuation (Source: GoldHub Australia)

Figure 2: GoldHub Australia Macroeconomy (Inflation Data) (Source: GoldHub Australia)

And that's it! Thank you so much for your continued support of our mid-weekly series. We hope you're enjoying it as much as you're learning from it. As always, we will see you next Wednesday!

For a limited time, you can use the promo code PULLBACK25 to get 50% off the first year of subscription.

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.