The Calm Before The Storm? Or, is the Storm Already Over?

December 11, 2025Good evening ladies and gentleman, welcome to The Australian Gold Mid-Weekly Review! For those of you tuning in for the first time, welcome! This is a series where we give you fresh insights into what's on this week in the precious metals and mining market, every Wednesday.

Well, this week has been highly anticlimactic for gold, as a series of hawkish comments from Fed officials has kept gold rangebound since Friday. It currently trades at US$4,210/oz, with a rate cut announcement coming up later today. However, looking into the future, the Fed may be careful cutting rates any further following stronger-than-expected jobs data. So, the question remains, is this the calm before the storm for gold prices, or will gold see an anticlimactic ending following the rate cut announcement? Well, there's only two sources who can answer that question: one is time, and the other is Brian, who will unpack this lingering question in Episode 20 of The Australian Gold Weekly Review on Sunday, once the dust settles down and the market takes a breather for a day.

Silver's Historic Breakout: A New Hero Emerges

Meanwhile, there seems to be a new hero in the market. Silver has crossed the US$60/oz barrier, bringing the gold-silver ratio to 69, the lowest since late-July 2021. If there's something to know about silver, it is that it is a higher beta asset compared to gold. In simple terms, it reacts with more volatility compared to gold in both bullish and bearish situations. In bullish scenarios, this can work great for you. However, portfolio allocations with respect to silver need to be managed carefully, as it can equally eat into your gains and portfolio size in unprecedented market downturns. We're tracking the silver market closely, let us know on our social media handles if you want us to dig (or mine 🙂) into the history of this metal and its outlook, like we've done for gold on our YouTube channel @TheAustralianGoldFund.

Why Are Gold Mining Stocks Lagging Behind Silver's Rally?

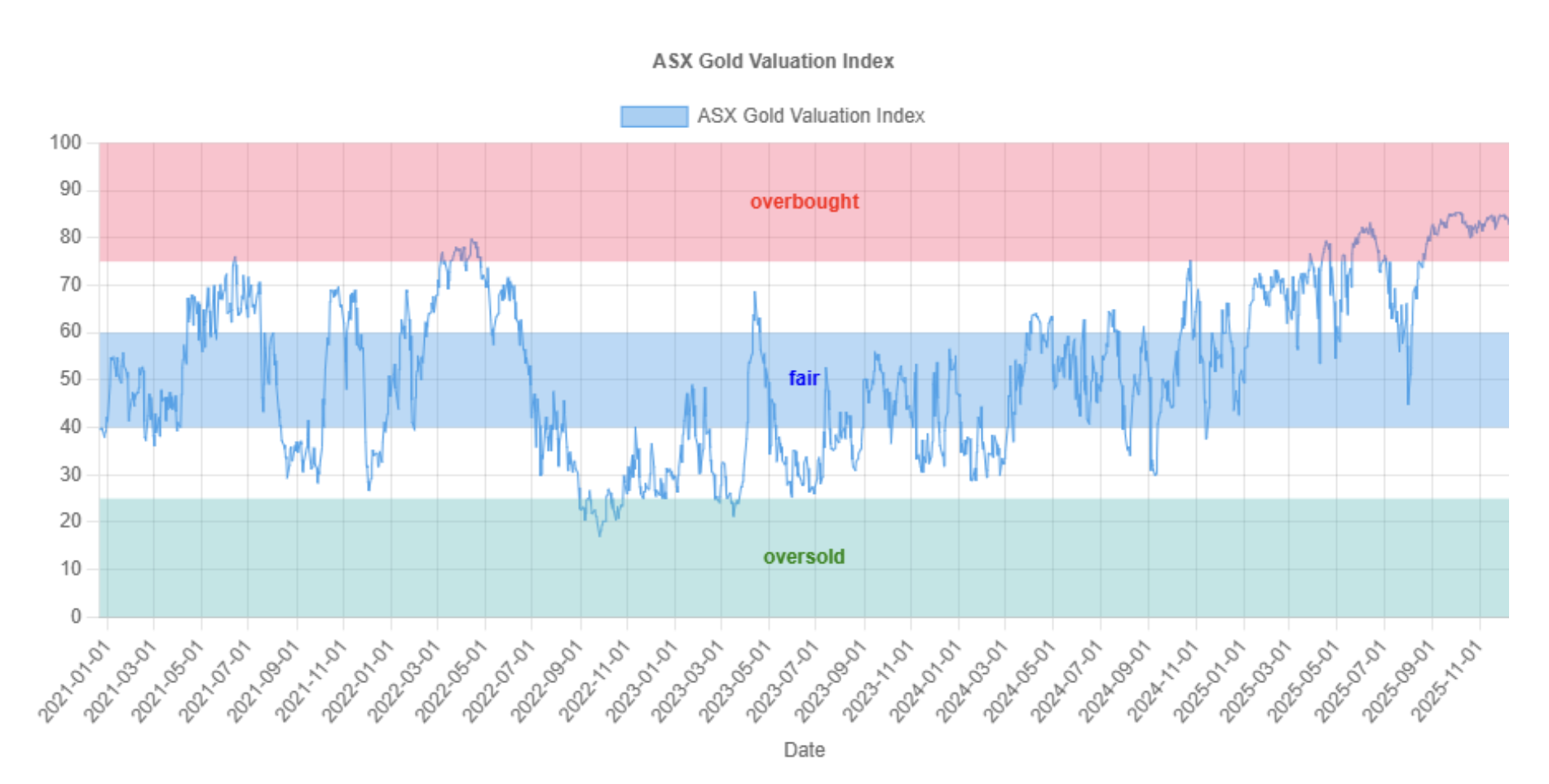

Meanwhile, the ASX-All Ordinaries Gold Index stands at 17,484.06 points today. It remained relatively flat and followed suit with gold this week, like the previous few weeks. However, we recently discussed the relationship between silver and gold mining stocks, and will be bringing that discussion back in Episode 20 of The Australian Gold Weekly Review. If silver is seeing an unprecedented breakout, why are mining stocks (ASX-All Ordinaries Gold Index) shying from a strong bull run? Keep in mind that gold stocks still linger in the overvalued range, as per our Gold Stocks Valuation Index.

Figure 1: ASX Gold Valuation Index (Source: GoldHub Australia)

And that's it! Thank you so much for tuning into our mid-week review. We hope that this series is able to bring you insights that you otherwise may not have come across, and that it positively fuels your investment journey. Until next week, stay curious and stay tuned in to The Australian Gold Fund!

For a limited time, you can use the promo code PULLBACK25 to get 50% off the first year of subscription.

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.