The End of the Beginning? Gold and Silver's Rallies Resume

November 13, 2025Good evening ladies and gentlemen, it's that time of the week again! Welcome to The Australian Gold Mid-Weekly Review! This series aims to publish an article every Wednesday to keep you updated on movements in gold, silver and metals and mining equities in the week thus far, so as to keep you comprehensively updated on your investment journey on a weekly basis!

This week, we might've seen a trend reversal. Gold was at its US$4,000/oz base range at the beginning of the week, and has now climbed to US$4,114/oz. This week, traders particularly took advantage of an easing dollar throughout the week which pushed gold prices up to as high as US$4,140/oz. With the U.S. government passing a deal to end the government shutdown, traders and investors will now await key economic data from the Fed to gauge the likelihood of a rate cut in December. The probability of a rate cut in December now stands at 68%, with Fed Governor Stephen Miran stating this week that a 50-points rate cut would be appropriate for December, noting that inflation is falling and unemployment is edging higher. A private employment report by ADP pointed to ~11,250 jobs lost per week in the private sector alone, in the four weeks ending October 25th. Should rates be cut by 50-points in December, gold could see its rally continue as the yellow metal tends to be a favourable asset in low-interest rate environments.

Meanwhile, silver has risen 7% in the week thus far, to US$51.6/oz, compared to US$48.3/oz at the start of the week. Silver was supported by investor flows into the metals early this week, with traders speculating increased demand for the metal upon the potential resumption of government industrial projects as the shutdown nears its end.

And finally, the ASX-All Ordinaries Gold Index is back to its winning ways, increasing 1,100 points in the week thus far to 17,086.71 points. It seems that most of the major gold producers have made up for the stock price losses they experienced early last week, with Evolution Mining, Northern Star Resources, Genesis Minerals and Perseus Mining all being up by ~7-11% this week, after a major rally on Tuesday upon market open.

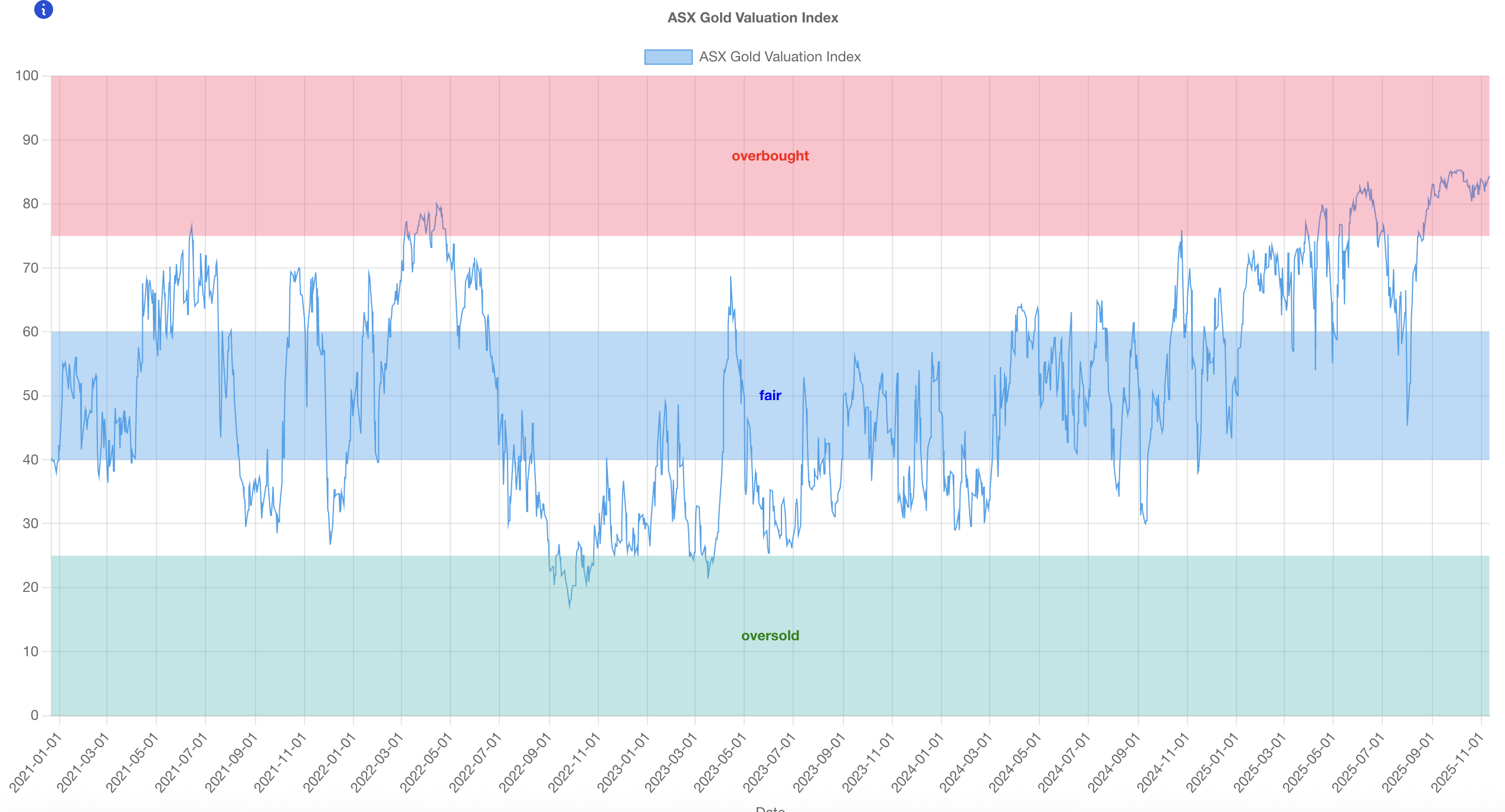

This means that our gold stocks valuation index still roams the overbought range, suggesting overstretched valuations among major gold producers. However, with fundamentals for gold prices remaining strong for the medium and long-term, and gold's consolidation seemingly coming to an end, does this mean we can expect to see gold producer valuations stretch further? Are we in a phase where market perception and commodity price strength dominates fundamental mining company performance? And if yes, how can we position ourselves to take advantage of both gold's price strength and investor perception among gold producers, as well as fundamental gold producer performance? You will find the answers to all these questions on Saturday, as we go live on The Australian Gold Weekly Review with our managing partner Brian Chu.

Well, that brings us to an end to this Wednesday's review. We hope we're able to bring in fresh insights to keep you updated on your investment journey. Stay tuned for Sunday, and don't forget to watch our previous episodes of The Australian Gold Weekly Review, streaming on YouTube. See you soon!

If you like our content, and want to learn more about our detailed analysis into gold mining companies, we provide additional content to our members. It is totally free to be our member, just sign up to our service, and we will share it with you through our newsletters.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.