Gold has begun to fall, but you don’t have to!

October 22, 2025Dear readers,

Welcome back to the mid-week review! This was a series we started last week to cover you in on everything that’s happened in the precious metals and mining market to keep you updated as you navigate your investment journey!

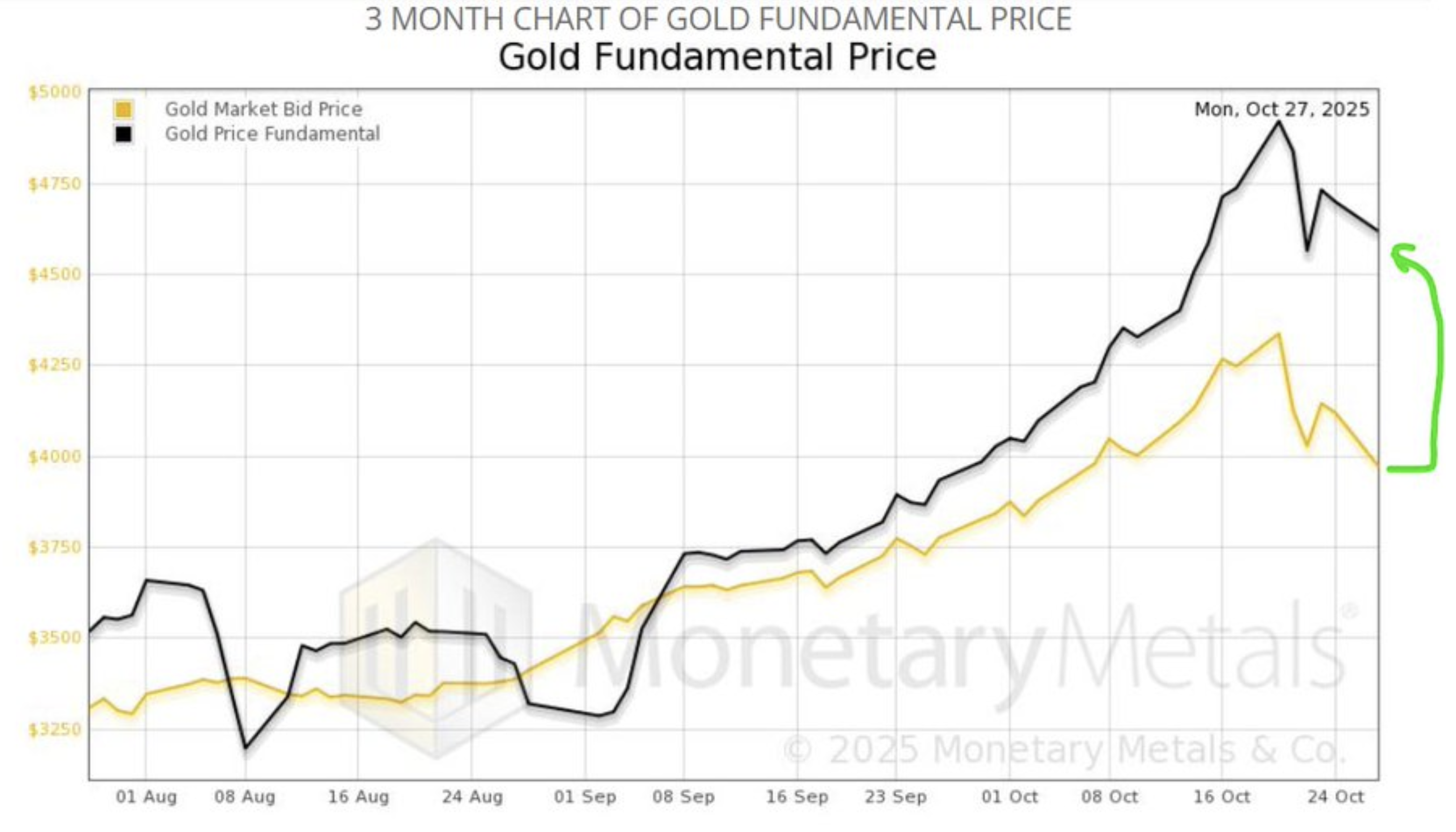

Well, this week’s is when everything we’ve been talking about finally begins to unfold. For the last three episodes on The Australian Gold Weekly Review, Brian’s been warning of overstretched gold – and, as an extension – gold mining equities’ valuations. Since last week, these inflated valuations turned into sell-offs, with gold seeing its biggest one-day and two-day sell-off since 2013, falling from upwards of US$4,300/oz to as low as US$4,000/oz last week. Even more shocking, the ASX-All Ordinaries Gold Index saw a 2,000 point decrease, as plummeting gold prices naturally triggered a sell-off among multiple gold producers. This week, the narrative has been the same. Gold has now tested the US$3,800/oz mark just yesterday, and big-name producers like Evolution Mining and Northern Star Resources saw their stock prices drop by 5% as soon as the market opened on Tuesday. However, the markets seem slightly more optimistic today. Traders are keenly awaiting the Fed’s decision on a rate cut, and Jerome Powell’s comments on inflation later today, raising gold prices back to US$3,970/oz. However, beyond the potential rate cut, factors such as easing trade tensions between the U.S and China, cooling geopolitical tensions, and reduced demand in Asia could see gold test the US$3,800/oz mark yet again, before fundamentals catch up and gold continues its rally.

Source: Correlation Economics, X.

Meanwhile, silver has continued to follow suit with gold, rising back to US$47.94/oz from its low of US$46/oz earlier this week.

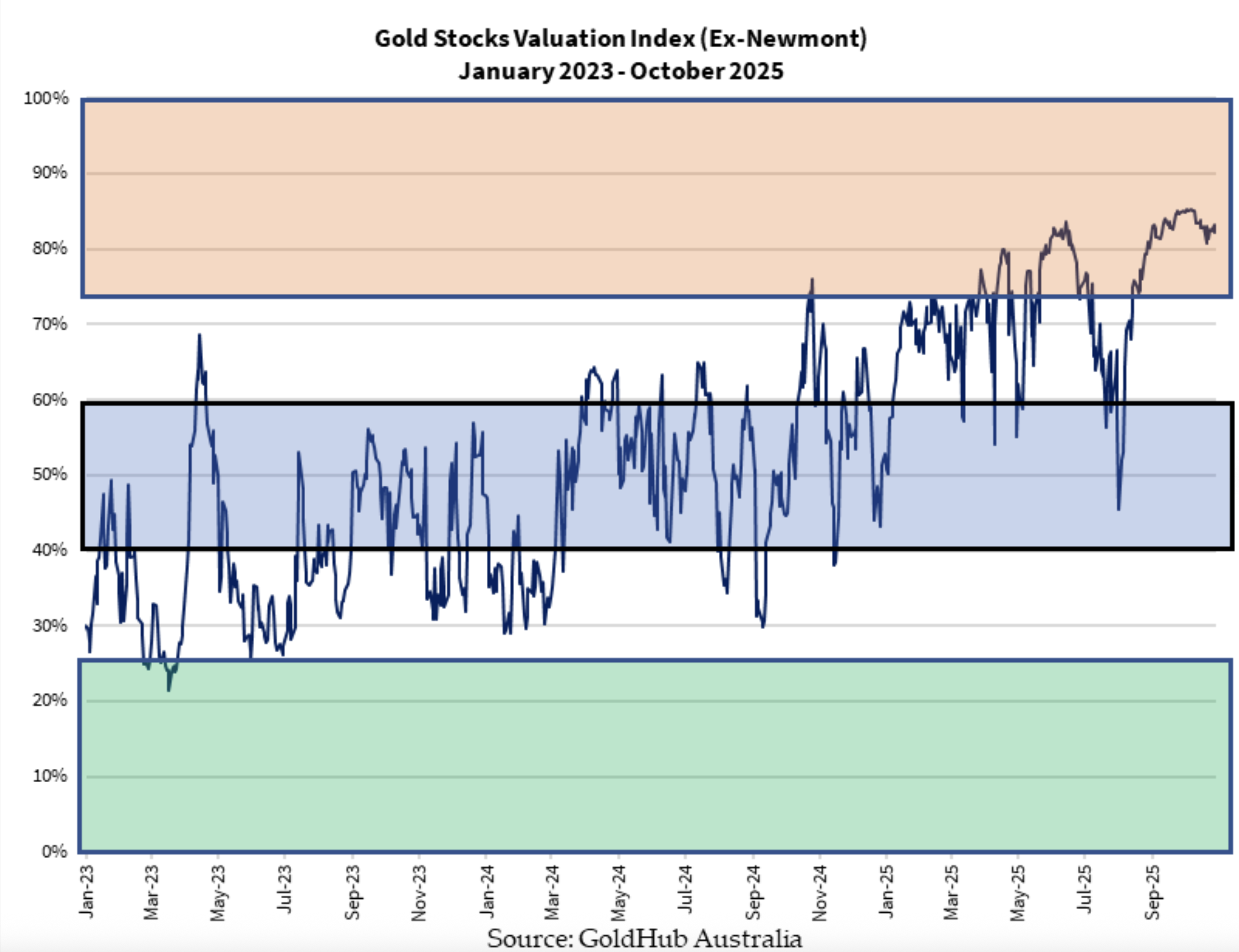

Meanwhile, our Australian gold stocks continue to trade in the overvaluation range, as per our ASX Gold Stocks Valuation Index:

Gold’s parabolic rally has really weighed on the valuations of these producers, as our index value currently sits at ~83 (out of 100), signalling there’s still room for many producers to correct before they enter the fair valuation range again. Keeping that in mind, The Australian Gold Fund has placed the majority of its holdings in gold developers, with only ~2% of holdings put into major gold producers.

And there you have it! That’s everything you needed to know so far this week to remain best updated on your precious metals investment journey. We’ll see you soon in Episode 14 of The Australian Gold Weekly Review on Saturday, where we will cover in detail the current macroeconomic environment, gold’s near-term outlook, and some overlooked companies!

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.