Gold Down in the U.S. and Australia as U.S Trade Negotiations Speculated to Extend; Australia Set to Become World's Largest Gold Exporter

July 28, 2025This week, gold prices dropped in both the U.S. and Australia---by 1.73% and 2.27%, respectively. U.S. gold ended the week at US$3,336.22/oz, while Australian gold settled at AU$5,082.34/oz.

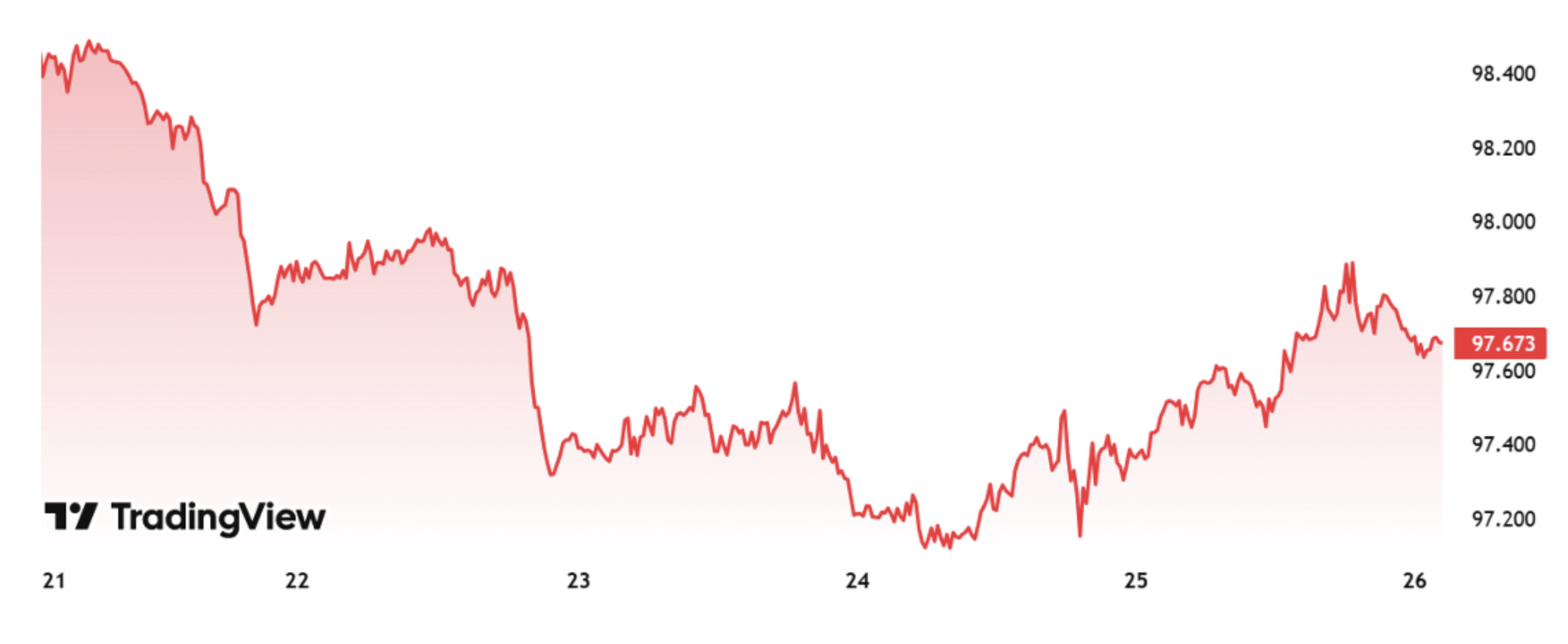

The week started strong. On Monday July 21, gold closed higher at US$3,395.90/oz as the U.S. dollar and Treasury yields weakened. The dollar index dropped from the 98 points range to 97, and the 10-year yield hit a two-week low. These trends made gold more appealing as a non-yielding asset.

Figure 1: Movements in the U.S. Dollar Index This Week [Source: TradingView]

By Wednesday, gold reached a five-week high of US$3,432.88/oz. This rise came as the US Dollar Index fell to its weekly lowest of 97.318, and concerns over trade tensions between the U.S., the EU, and China grew.

No significant progress was made in the U.S.--EU trade talks ahead of the August 1^st^ negotiations deadline. Market rumours suggested the deal might fall through, which could lead to new tariffs on EU goods. EU officials even hinted at strong countermeasures. Separately, Treasury Secretary Scott Bessent floated the idea of extending the China tariff deadline to August 12^th^, signalling slow progress there as well.

Mid-week, the momentum faded. However, this did not come from trade updates. The US Dollar Index bounced slightly to just below 98 points, while treasury yields rose, as convictions of an early rate cut in next week's Federal Reserve meeting faded. Traders began locking in profits on gold, pushing the metal to close the week at US$3,336.22/oz.

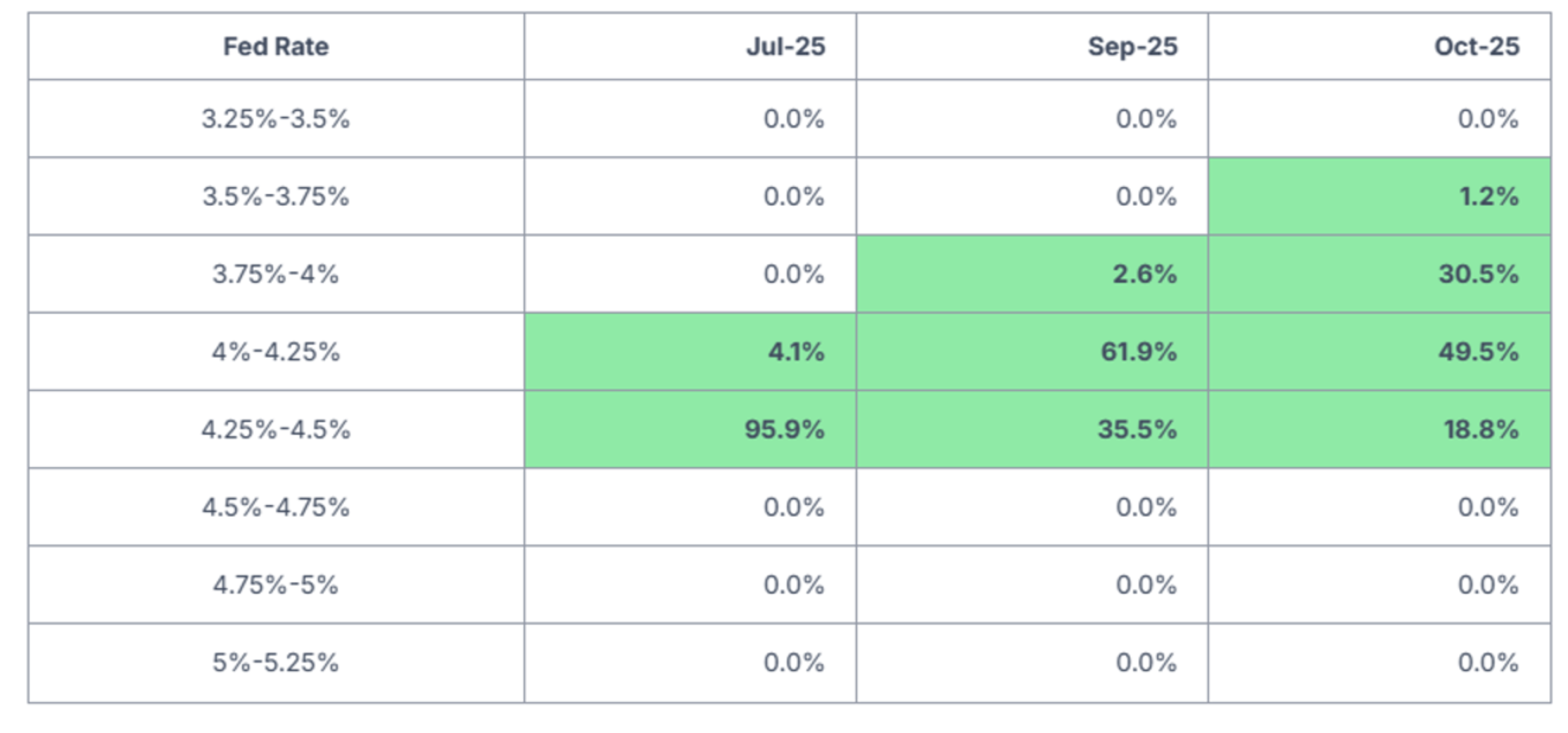

The CME Group currently puts the odds of a September rate cut at 61.9%, which we have noted in our projections in our membership page:

Figure 2: Federal Funds Rate Monthly Projections (Source: GoldHub Australia)

Gold retreated more in Australia during the week as the AUD strengthened by 0.80% against the US dollar. Expectations of stronger commodity export drove this. A government quarterly commodities projections report showed gold could soon overtake coal in export value, forecast at AU$56 billion---second only to iron ore. This would reinforce Australia's position as the world's top net gold exporter and third-largest producer.

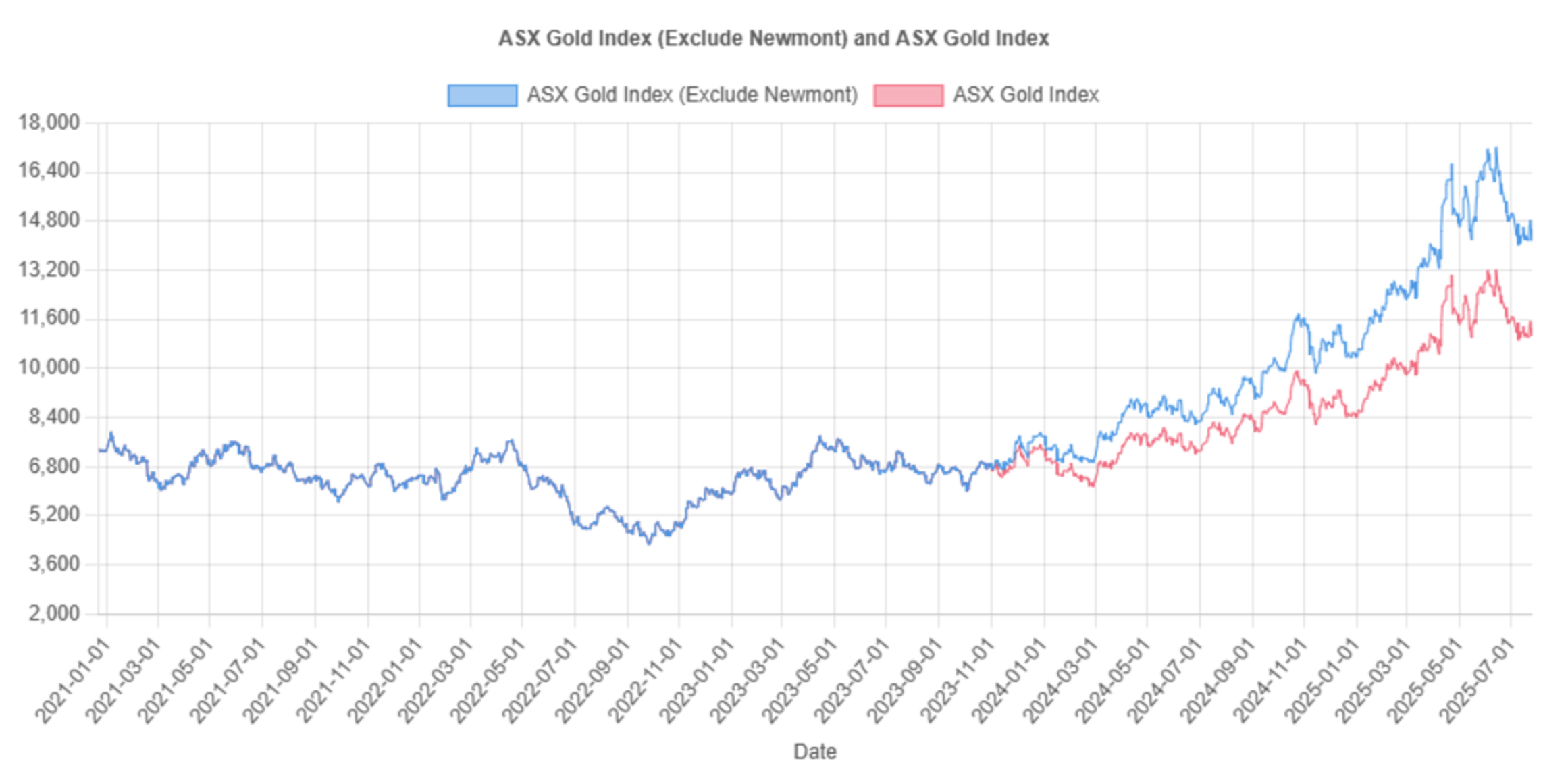

The ASX All Ordinaries Gold Index only gained 45 points this week. It rose by almost 500 points at the start of the week until Wednesday before falling back to Monday's level, mirroring the price movement in gold.

Figure 3: Movements in the ASX-All Ordinaries Gold Index (Including and Excluding Newmont Corporation) (Source: GoldHub Australia)

Investor sentiment started strong at the start of the week when iron ore prices surged due to optimism over Chinese infrastructure projects would boost demand from Australian materials companies. This lifted mining giants like BHP, Rio Tinto, and Fortescue by 2--3%, boosting the materials sector. Gold stocks rallied too, as investors rotated into mining equities. As a result, the index jumped almost 500 points between July 21 and 23.

However, the sentiment cooled by July 24--25. Materials companies' gains eased, and investors took profits from previously strong-performing mining equities as gold prices fell, and the Australian dollar rose. This created concern that higher currency strength could reduce short-term margins for gold miners.

However, one standout performer this week was Pantoro Gold (ASX: PNR). Its stock price rose 22%, following strong quarterly results. Pantoro reported gold production of 25,417 oz, near the higher end of their guidance. Margins improved by AU$906/oz, and operating revenue reached AU$124.7 million, 60% higher than last quarter. Recovery rates rose to 96%, and head grades hit a yearly high of 2.83g/t---a 40% increase.

Pantoro is now debt-free, with AU$175 million in cash. The company increased its profitability this financial year, having turned from a loss-maker in 2023 to making a modest profit last year. Since then, strong quarterly profits have caused investors to significantly re-rate the company. With record annual EBITDA of AU$200 million, investors are now factoring in sustained profitability. Pantoro's share price is up 154.79% in the past year, closing the week at AU$3.72.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.