Gold Neutral, Silver Set a 13-Year Record as the US Dollar Sets Up for a Rebound Amidst Stronger US Economic Data

July 21, 2025This week, gold rose 0.19% in the U.S and 0.71% in Australia. Gold traded at US$3,350.40/oz and AU$5,145.62/oz at market close on Friday. The U.S. dollar closed on a three-week high and the risk of increasing real yields held back gold's rally. With only two rate cuts projected for 2025, investors may rush to the bond markets rather than gold to take advantage of increasing real yields.

However, Richard Letterman, the Head of Portfolio Solutions at ReSolve Asset Management, believes the U.S dollar's recovery may not last. He argues that the U.S dollar is heavily dependent on the public's trust in the Fed. This trust is deteriorating given its poor record of maintaining economic stability and controlling inflation. Furthermore, President Trump's feud with the Federal Reserve Chair Jerome Powell opens the possibility of Jerome Powell resigning or being replaced by a new chairman. This could be positive for gold.

Meanwhile, silver continued its bullish trend, ending the week above US$38 an ounce. Analysts at Citigroup have predicted silver to increase by 13% by the end of 2025. They project the demand for the metal at 1.2 billion ounces, exceeding supply of 1.05 billion ounces. The gold-silver ratio is further fuelling silver's increase, having come down from just over 100 for over two months since April to 85. There are signs suggesting it could fall further to the long-term average of 70, which could send silver to almost US$50.

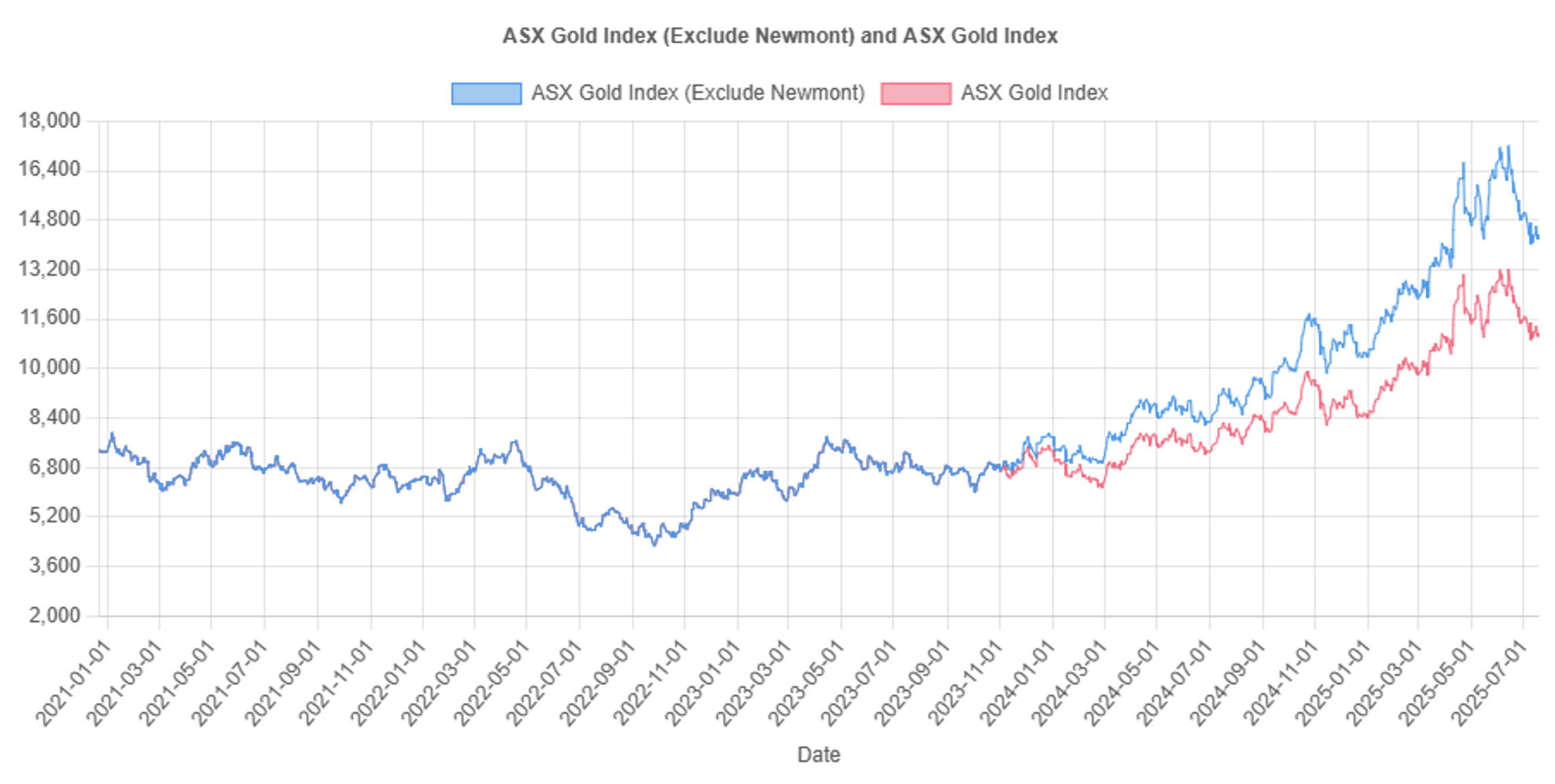

Meanwhile, the ASX-All Ordinaries Gold Index increased slightly during the week, closing at 11,145.9 points.

It remains more than 15% below its record highs set on 16^th^ June:

Figure 1: Movements in the ASX-All Ordinaries Gold Index (Including and Excluding Newmont Corporation)

The selloff in the past month appears to be over. However, there may not be a quick recovery, arising from the following factors:

-

Analysts downgraded several mining companies this week. This signalled a consolidation phase for "easy win" gold stocks that have become overvalued.

-

Gold is lacking a trend, causing investors to become restless as they wait for a positive signal to resume buying.

-

The leading gold miner, Newmont Corporation, suffered a big one-day drop this week after the Chief Financial Officer, Karyn Ovelmen, resigned from the company. Along with the weakness from another leading gold producer, Northern Star Resources, this may be holding back sentiment for gold stocks.

Lastly, Genesis Minerals reported their strongest year yet. It surpassed their upgraded guidance by producing 214,311 ounces of gold. It reported its quarterly results on Thursday, showing that its operating cash flow was $125 million. The unaudited net profit after tax for the quarter was $85-95 million, while full year NPAT was $210-230 million. The AISC came in slightly higher than their guidance at $2,499 an ounce.

To top off a great year, the company recently announced a strategic acquisition of Focus Minerals' assets. This contributed further to the company's 'ASPIRE400' vision to produce 400,000 ounces of gold annually. Looking ahead, open-pit mining is due to begin in September 2025, adding more ounces to the Laverton operation, which recently resumed operation. Genesis Minerals (ASX:GMD) closed on Friday at AU$3.93. Compared to the past month, the share price is down by nearly 15%. This is despite the company's positive quarterly report and strong growth potential.

Investors have been taking profits on gold producers since June. Sometimes they have paid little regard to the company's current performance. Genesis Minerals is no exception. Even then, it enjoyed a solid 82% gain since last year and nearly 60% for 2025, thanks to gold rallying. This gold bull market helped spur excellent operating results for many gold producers. This in turn boosted investor perception and enticed them to buy these companies over the past year. The recent profit taking is driven by many companies becoming overvalued. However, the release of positive June quarter results that surprise to the upside could turn the trend around. Companies like Genesis Minerals that show a consistent record of delivering a solid operating margin and growing their businesses could reward their shareholders in the long-term.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.