Tariff shock and the Israel-Hamas conflict boost gold during the week. Silver makes 13-year highs

July 13, 2025This week, gold rose in both the U.S and Australia. In the U.S, gold prices increased by 0.66% to US$3,354.75/ounce at market close on Friday. In Australia, gold prices rose by 0.74% to AU$5,103/ounce as of market close on Friday.

Gold rose this week after President Trump announced new tariff measures, including a 35% tariff on Canadian imports effective from August 1st onwards, and tariffs of 15 to 20% on most other trading partners. Perhaps the most shocking was a 50% tariff on all copper imports, causing a surge in copper to an all-time high of US$5.60 a pound. This partly spurred investors to rush to gold as a safe-haven asset.

Besides tariffs, gold received a boost as Middle East tensions hit the headlines. The conflict between Israel and Hamas persisted around the Gaza Strip. This added another layer to market uncertainty. There are talks of a potential ceasefire between the two sides, but negotiations continue amidst the conflict.

In Australia, gold initially retreated as the Australian currency appreciated against the U.S dollar. However, the uncertainty over the extension of tariffs and Middle East tensions caused the US dollar to strengthen at the close of the week. This caused gold to jump above AU$5,100 on Friday. It traded as low as AU$5,030 during the week.

What is notable this week is silver. It hit another milestone after the metal closed at US$38.39 on Friday, hitting a 13-year high:

Figure 1: Silver sets a new high since 2011

Silver traded between US$28-34 range for nearly a year. This significant breakout comes from supply constraints given the metal’s role in green energy demand. It is also responding to rising gold and copper prices, which it currently lags.

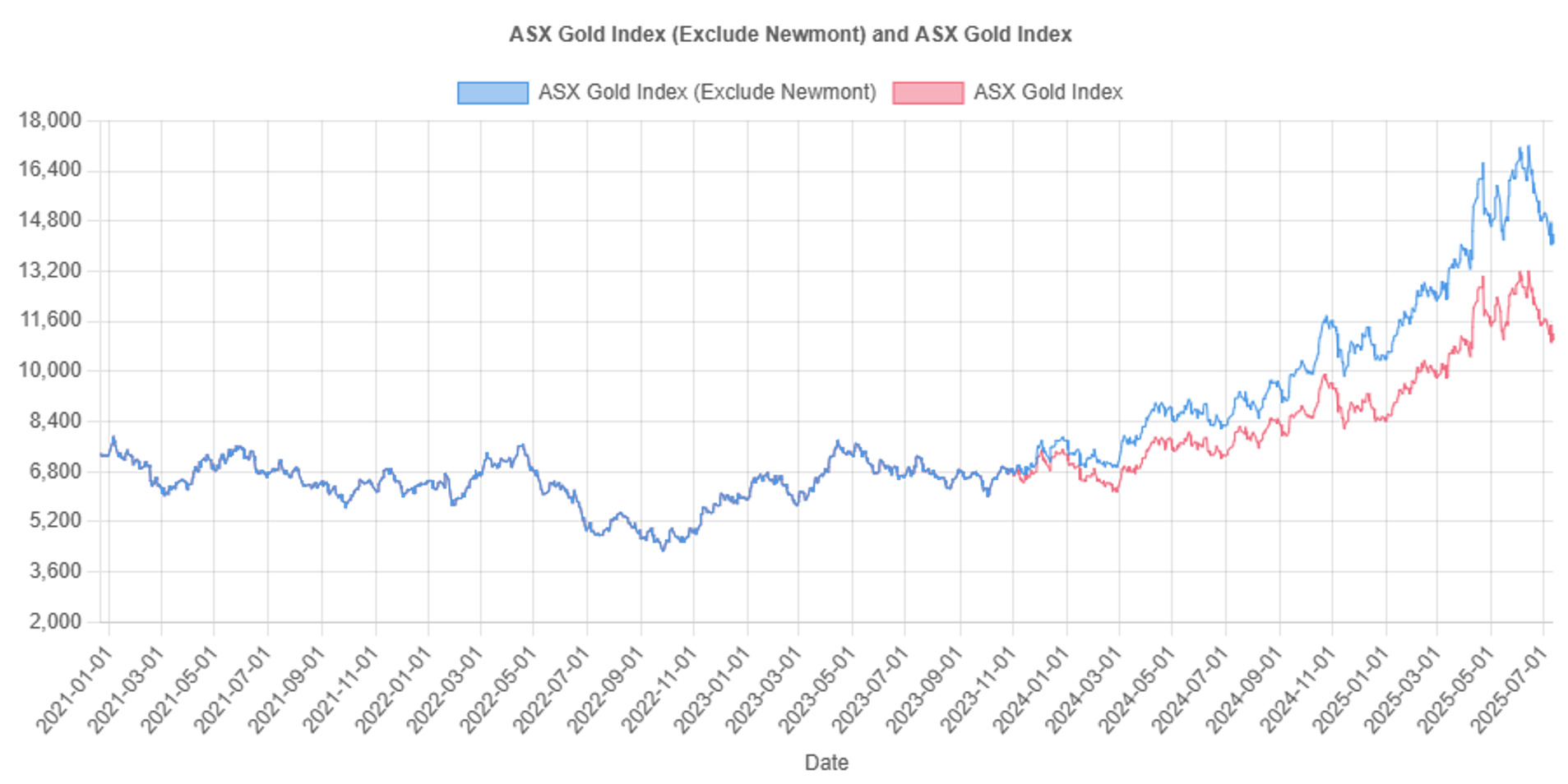

Meanwhile, the ASX-All Ordinaries Gold Index this week fell by 164.2 points to 11,006.45 points. The index has declined by over 15% from its all-time highs on 16th June, continuing to show weakness despite gold and silver’s solid performance:

Figure 2: Movements in the ASX-All Ordinaries Gold Index (Including and Excluding Newmont Corporation)

Part of this fall comes from profit-taking by investors who enjoyed several months of gold surging and oil trading between US$58-75 a barrel. These led to strong gains for the larger gold producers. Furthermore, Northern Star Resources reported disappointing preliminary operating results for the 2025 June quarter during the week. Its share price retreated by over 10% after the announcement, closing at AU$16.25. Despite positive updates from other producers including Bellevue Gold, Ramelius Resources, and Regis Resources, these were not enough to offset the market’s response to Northern Star Resources.

Finally, Ausgold Limited (ASX:AUC) announced on Thursday a $35 million raising at 57 cents per share to accelerate the company’s Katanning gold project. The funds will go to acquiring neighbouring land and reaching a financial investment decision to build this mine. A recently released definitive feasibility study stated the potential for 140,000 ounces per annum of gold production across four years. This mine will deliver a total of 1.14 million ounces throughout its mine life of ten years. Management further claimed that this would deliver AU$1.37 billion of post-tax cash flow at a $4,300/ounce gold price. Ausgold currently trades for AU$0.59 on the ASX, having traded as high as 76.5 cents on 27th June 2025.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.