Gold ended higher despite stronger-than-expected US economic data

July 4, 2025This week, gold prices in the U.S and Australia both closed higher in the U.S and Australia. In the U.S, gold rose by 1.8% for the week as it traded at US$3,332.78 at market close on Friday. Meanwhile, gold increased 0.7% in Australia, trading at A$5,065.64 at market close on Friday.

The U.S gold prices ended stronger this week despite hawkish Fed expectations from economic data that beat expectations. The U.S non-farm payroll report also outperformed consensus, and the unemployment rate dropped to ~4.1%. This boosted confidence in the economy and reinforced expectations of the Fed keeping interest rates higher for longer. Gold opened strong on Friday but pared back its gains as investors reduced their exposure to the safe haven yellow metal. Meanwhile, in Australia, the increase in gold prices came from a weaker Australian dollar from the positive US economic conditions.

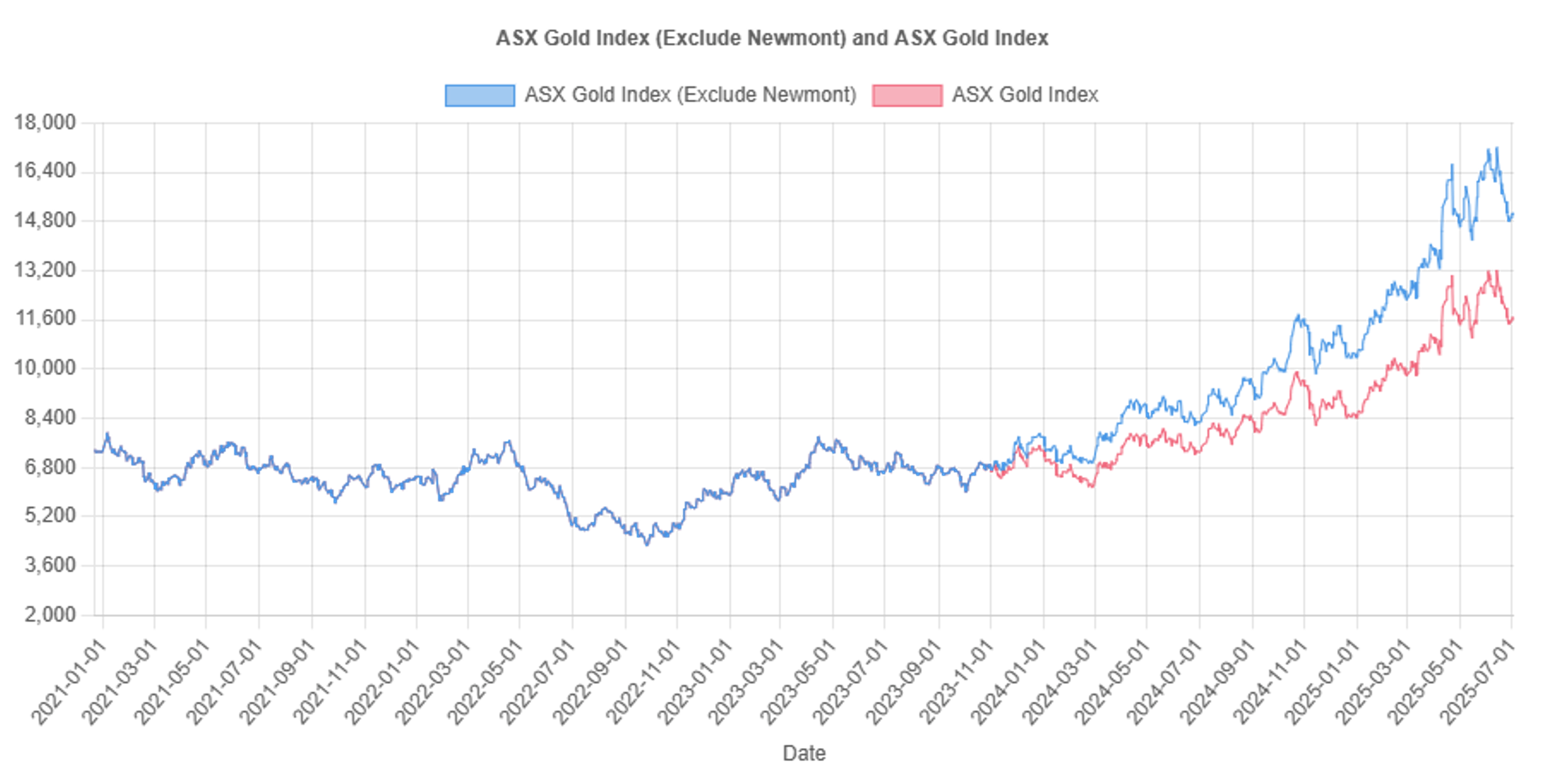

The ASX-All Ordinaries Gold Index roses slightly by 37 points, ending the strong selling trend that lasted for a fortnight. Australian gold stocks benefited from the general safe haven demand for gold as well as a stronger U.S dollar against the Australian dollar. Investors are positioning for an improvement in the operating margins of the companies if things continue this way.

Figure 1: Movements in the ASX-All Ordinaries Gold Index (Including and Excluding Newmont Corporation)

Gold producers Vault Minerals, Capricorn Metals, and Black Cat Syndicate released their June quarter results. Vault Minerals and Black Cat Syndicate ended the FY25 year on a strong note. Specifically, Black Cat Syndicate, processed nearly 13,000 ounces during the June quarter from its newly acquired Lakewood facility despite shutting down for a few days. The company’s total production for the quarter was 21,700 ounces, with its Paulsens gold operation delivering 23% more gold than the previous quarter. Moreover, the Myhree open-pit operation became cash flow positive in May, with other deposits progressing ahead of schedule. These deposits are expected to begin delivering ore in October. Black Cat Syndicate closed the quarter with $55 million in cash and bullion. It ended the week at A$0.82, up 7% this week, and 126.39% in the last year alone.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.