Gold Suffers from Easing Geopolitical Tensions and Stronger U.S Economy

June 28, 2025This week, gold’s price saw a decline in both the U.S and Australia. In the U.S, gold traded at US$3,273 at market close on Friday, a 2.8% drop over the week. In Australia, gold fell by 3% compared to Monday to A$5,014 at market close on Friday. The biggest decline happened on Friday while the US markets traded.

The most immediate drivers of this price drop are the easing geopolitical tensions in the Middle East and higher than expected US inflation. The ceasefire agreement between Israel and Iran on June 24 diminished the safe-haven demand for gold, taking the price down to pre-conflict levels. The US Bureau of Labor Statistics released the inflation data showing similar readings to the previous month’s reading. But core inflation (inflation after removing volatile items such as food and energy) increased by 0.2% over the month, up from 0.1% last month. This accelerating inflation supported the US Federal Reserve’s decision last week to hold the Federal Funds Rate steady for longer citing uncertainty over the economy.

In addition to this, market sentiment has shifted towards the equity markets, contributing to declining gold prices. Investors now appear more confident about global growth, due to signs of easing trade tensions between major economies such as the US and China. Moreover, positive economic data releases in the US recently, namely strong durable goods orders and a tight labor market have reinforced expectations of delayed or less interest rate cuts by the Fed in 2025. This shift in policy expectations has also resulted in higher US treasury bond yields, making non-yielding assets such as gold less attractive.

In Australia, gold prices mirrored global trends but were also influenced by local currency fluctuations and sector-specific events. The Australian dollar’s relative strength against the US dollar helped cushion some of the decline, but not enough to offset the global bearish momentum in gold. Furthermore, with strong production from Australian gold miners and renewed interest in local equities, domestic investors may be reallocating funds out of bullion and into shares, particularly as the S&P/ASX 200 edges higher. According to The Australian, gold ETF inflows have cooled, reflecting this broader portfolio repositioning.

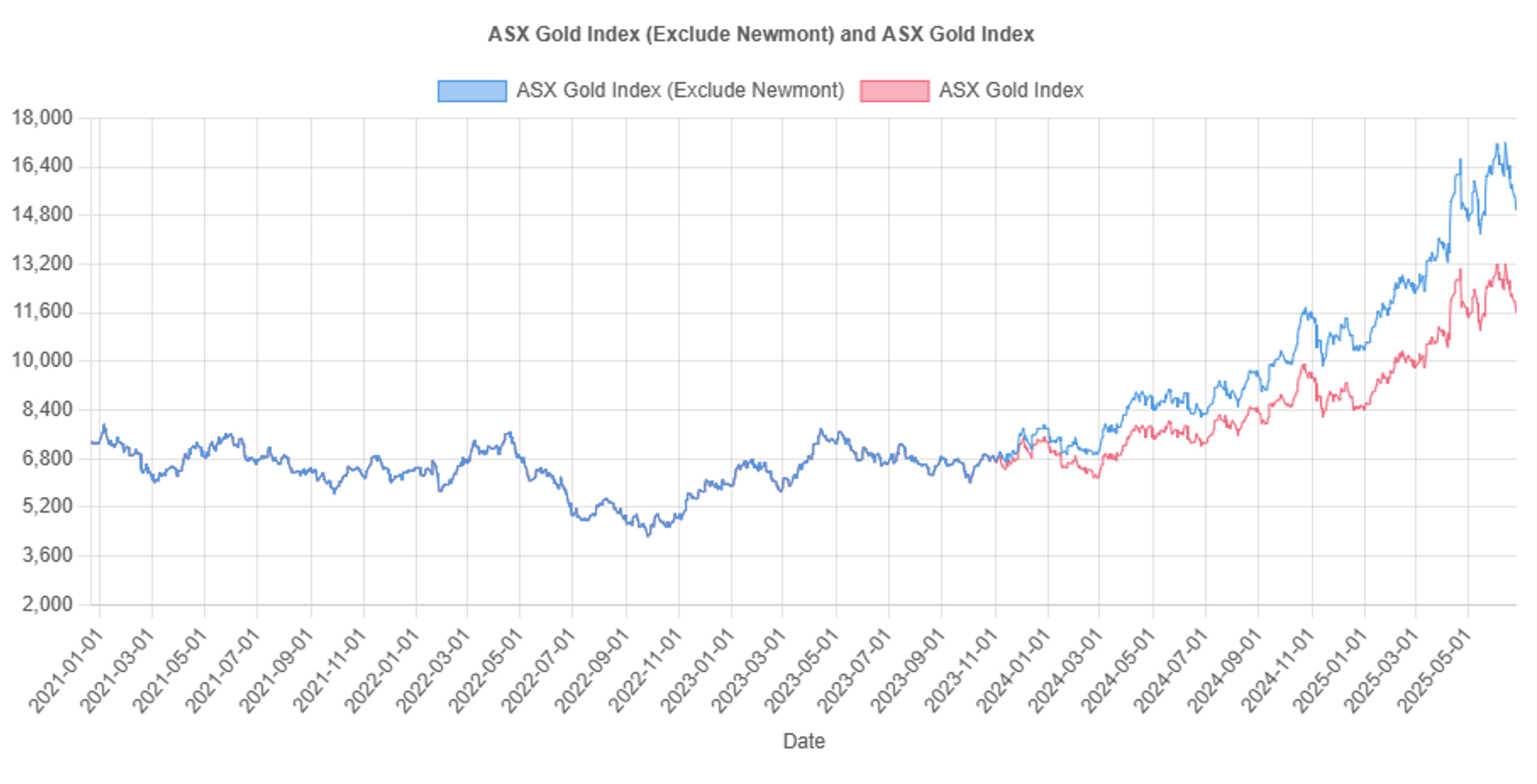

Meanwhile, shifting consumer preferences have also reflected in the ASX-All Ordinaries Gold Index, which fell by 492 points since Monday to close 11,481 points, the lowest level in the past month. Many major ASX-listed gold producers saw their share prices fall, such as Northern Star Resources, whose stock price has fallen 11% since Monday. In addition to dropping gold prices, broader equity market trends have contributed, as suggested above. The ASX All Ordinaries Gold Index, constructed from GICS gold sub‑industry constituents, amplifies the effect of even modest metal price declines. Another factor is that gold stocks tend to sell in late-June as investors book their capital gains and losses before the new financial year.

Figure 1: Movements in the ASX-All Ordinaries Gold Index (Including and Excluding Newmont Corporation)

And finally, late-stage gold and antimony developer Larvotto Resources (ASX:LVR) has received formal approval for its Hillgrove antimony-gold project, paving the way for production to start in 2026. Managing Director Ron Heeks said: “With formal approval now secured, we can immediately finalise financing and move towards a 2025 restart of operations demonstrating Hillgrove’s true potential as a globally strategic antimony and gold asset.” He also stated that this milestone validates Larvotto’s development strategy and keeps them on track to start production in 2026. The company is also applying to increase its processing capacity to 500,000 tonnes per annum. Larvotto Resources’ share price has delivered a 16% return year-to-date and a 535% return within the last year. The company currently trades at A$0.64 on the ASX.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.