Investor Uncertainty Pushes Gold and ASX Miners Lower Amid Mixed Signals

June 23, 2025This week, gold saw a slight correction of prices in both the U.S and Australia. In the U.S, gold went down marginally by 0.99% to US$3,367.64/oz at market close on Friday, while gold in Australia went down slightly more by 2.68% to A$5,170.75/oz. A hawkish Fed tone as predicted last week, coupled with relatively contained conflict in the Middle East as the week passed contributed to investor’s selling positions throughout the week, causing consistent price drops for the majority of the week.

Currently, Wall Street remains neutral on gold’s near term direction. According to analysts, gold right now is ‘a Middle East trade’, with war concerns driving increasing purchases of the yellow metal which was responsible for last week’s surge in gold prices above US$3,400. Adam Button, head of currency strategy at Forexlive.com, believes that the gold market will eventually circle back to the trade war, the budget, and potentially even AI as drivers of gold prices.

Aside from the geopolitical tensions in the Middle East, next week’s focus will be on U.S consumer health, with housing, inflation and confidence data releasing as the week unfolds.

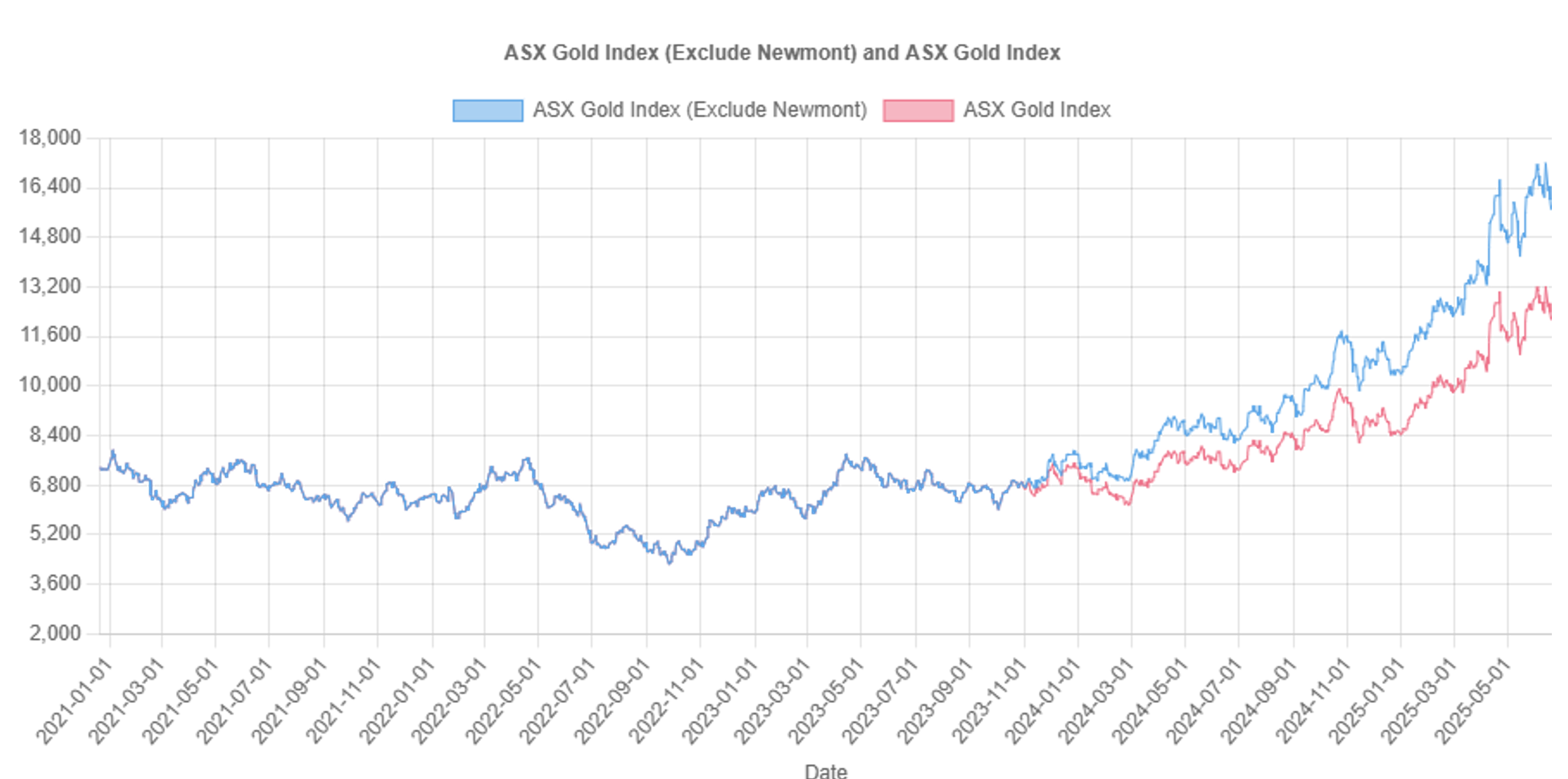

Meanwhile, the ASX-All Ordinaries Gold Index mirrored the global retreat, falling by 324 points to 12,225.34 points as of Friday. Global price challenges and profit-locking ahead of important economic data releases kept the general tone subdued, despite areas of strength among smaller explorers reporting development. The attitude among mining company stocks is missing directional confidence until gold itself finds firmer footing. The biggest example of this is Evolution Mining’s (ASX: EVN) stock, that reacted very positively to gold’s price surge above A$5,300, and is now down 16.36% this week as of Friday’s market close in response to gold price corrections globally.

Figure 1: ASX-All Ordinaries Gold Index Movements (Including and Excluding Newmont Corporation) (Source: GoldHub Australia)

Finally, in corporate developments, Evolution Mining (ASX: EVN) remained under investor scrutiny this week following its June Quarter 2025 Conference Call Notification, lodged on 16 June. The announcement confirmed that the company will discuss its latest quarterly performance on 16 July, offering insight into June quarter production, cost trends and progress on its high-profile Cowal expansion and Mungari mill commissioning programs. Trading around A$7.82—near the bottom of its recent A$7.70–A$8.15 range, analysts are expected to focus on whether free cash flow metrics remain robust amid gold’s recent pullback, and whether capital allocation toward long-life assets like Cowal continues to receive priority. This scheduled call provides a critical near-term catalyst for EVN, and could reshape sentiment if early indicators of mine performance or project timing surprise to the upside.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.