Metal Moves: Gold’s Global Tug-of-War

June 8, 2025This week, gold prices in the U.S and Australia went different directions in the respective countries, but only marginally. In the U.S, gold traded at US$3,324.10 at market close on Friday, down 1.5% compared to the start of the week. Meanwhile, gold in Australia traded at A$5,185.54 at market close on Friday, up just 1% from Monday. According to analysts, gold’s failed breakout at US$3,400/oz, coupled with a relatively stable labor market, could keep prices within this range for the near term. However, gold still holds plenty of upside potential this year.

Despite the fact that gold saw some profit taking this week, as well as the metal’s inability to breakout at US$3,400/oz, analysts believe that gold’s ability to hold their support levels above US$3,300/oz shows the metal’s underlying strength in the marketplace. Moreover, the selling pressure on gold this week strengthened after economic data showed that the U.S created 139,000 jobs in May, which beat the consensus forecasts. To add to that, the unemployment rate remained unchanged at 4.2% and wages grew more than expected, adding fuel to the fire.

However, with the employment data now out of the way, analysts are now focussed on the inflation factor, awaiting the release of the May Consumer Price Index next week. As of now, it is anticipated that the data will not support a rate cut before the summer. In terms of gold, a stronger than expected CPI could strengthen the USD and further reduce Fed cut bets, while a weaker than expected CPI could boost gold prices.

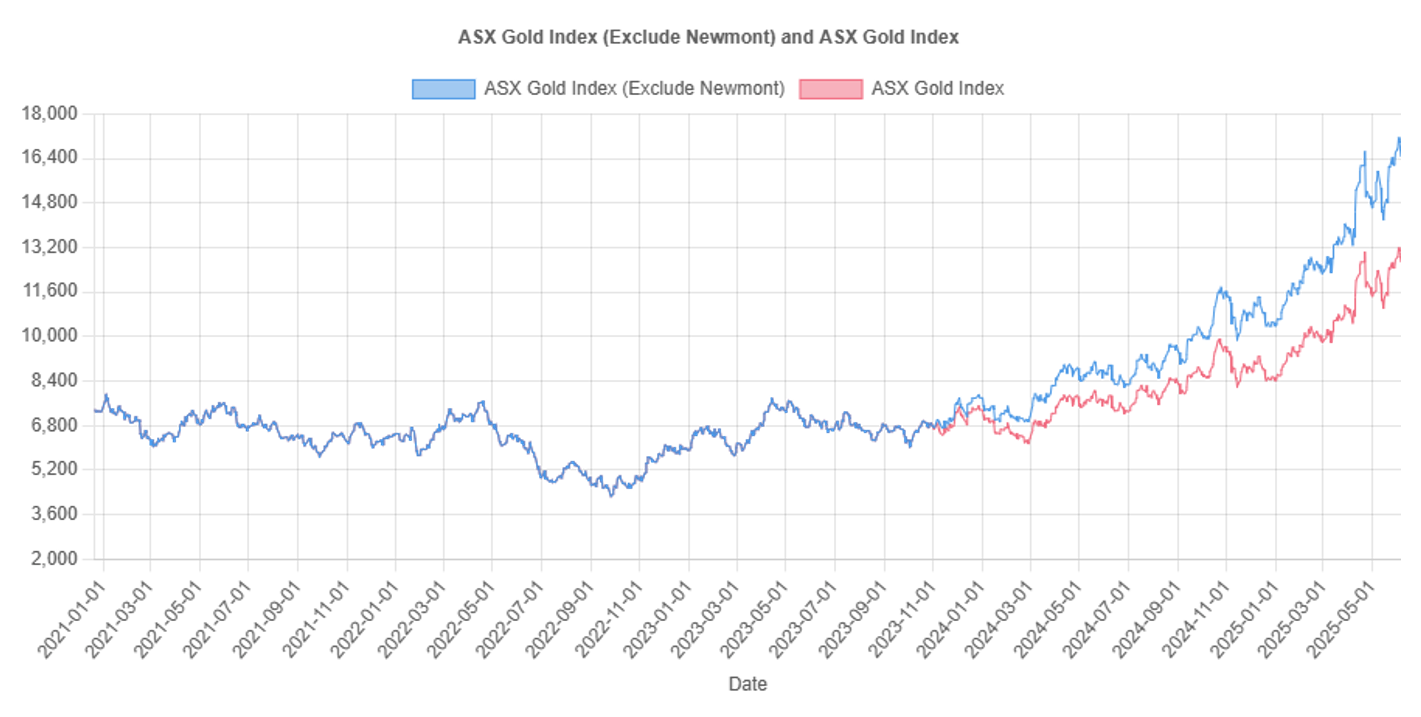

Meanwhile, the ASX-All Ordinaries Gold Index has climbed down 179.04 points this week to 12,690.48 points. This is a result of profit-taking activities across gold and gold producer activities this week, with many major miners being down this week, such as Ora Banda being down nearly 15% within a day on Friday.

Figure 1: Movements in the ASX All Ordinaries Gold Index (Excluding and Including Newmont Corporation) (Source: GoldHub Australia)

Finally, Evolution Mining (ASX:EVN) has revealed a strong uplift in its gold and copper holdings in its latest mineral resources and ore reserves update. The company now estimates its group mineral resources contain 30 million ounces (Moz) of gold and 4.4 million tonnes (4.4Mt) of copper. Lawrie Conway, CEO of Evolution Mining, said: “Our mineral resources and ore reserves update demonstrates the quality of our portfolio with an average mine life of 15 years, having more than doubled since Evolution’s inception in 2011.” This increase reflects solid growth at the Mungari mine in Western Australia (up 1.3Moz), the Ernest Henry mine in Queensland (up 400,000 ounces), and the Northparkes mine in New South Wales (up 400,000 ounces). This growth was partly balanced by a decrease of 4.5Moz at the Red Lake mine in Canada, along with small changes at the Cowal mine in NSW and the Mt Rawdon operation in Queensland. This reduction in Red Lake’s mineral resource is linked to Evolution Mining’s revised approach focussed on operational stability and sustainable cash flow generation. With significant, noteworthy increases in both mineral resources and ore reserves, Evolution Mining is continuing to build on a decade of organic growth and strong performance. In the last 6 months, the company’s stock price has gone up nearly 80%, and 136.44% in the last year.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.