Long-Term v/s Short-Term: Gold’s Double Entendre Story

May 30, 2025This week, gold saw a slight correction in prices in both the U.S and Australia. Gold in the U.S is down 1.6% compared to the start of the week, trading at US$3,285.34/ounce at market close on Thursday. Meanwhile, in Australia, gold saw a much smaller decline of 0.3%, with gold trading at A$5,122.51/ounce. Analysts at Fidelity call for caution on the investors’ part in response to gold’s massive rally, despite the long-term drivers for gold’s bullish run being in place.

Despite gold being up by approximately 50% in both the U.S and Australia in the past year alone, there are two primary reasons why analysts believe the long-term drivers of gold’s bullish momentum are still intact. These are: central bank purchasing and ongoing geopolitical and economic uncertainties. We have already covered the effects of the ongoing trade wars in our previous market commentary reports. However, two new macroeconomic releases have accelerated gold’s rally. Firstly, coupled with growing recession risks, the U.S GDP contracted by 0.2% in Q1 . Secondly, Moody’s, a premier credit rating agency, has cut the U.S’ credit rating from ‘Aaa’ to ‘Aa1 ’, which basically indicates a weakening confidence in the U.S’ ability to repay their debts on time. These economic releases have caused a ripple effect and caused gold’s rally to remain accelerated.

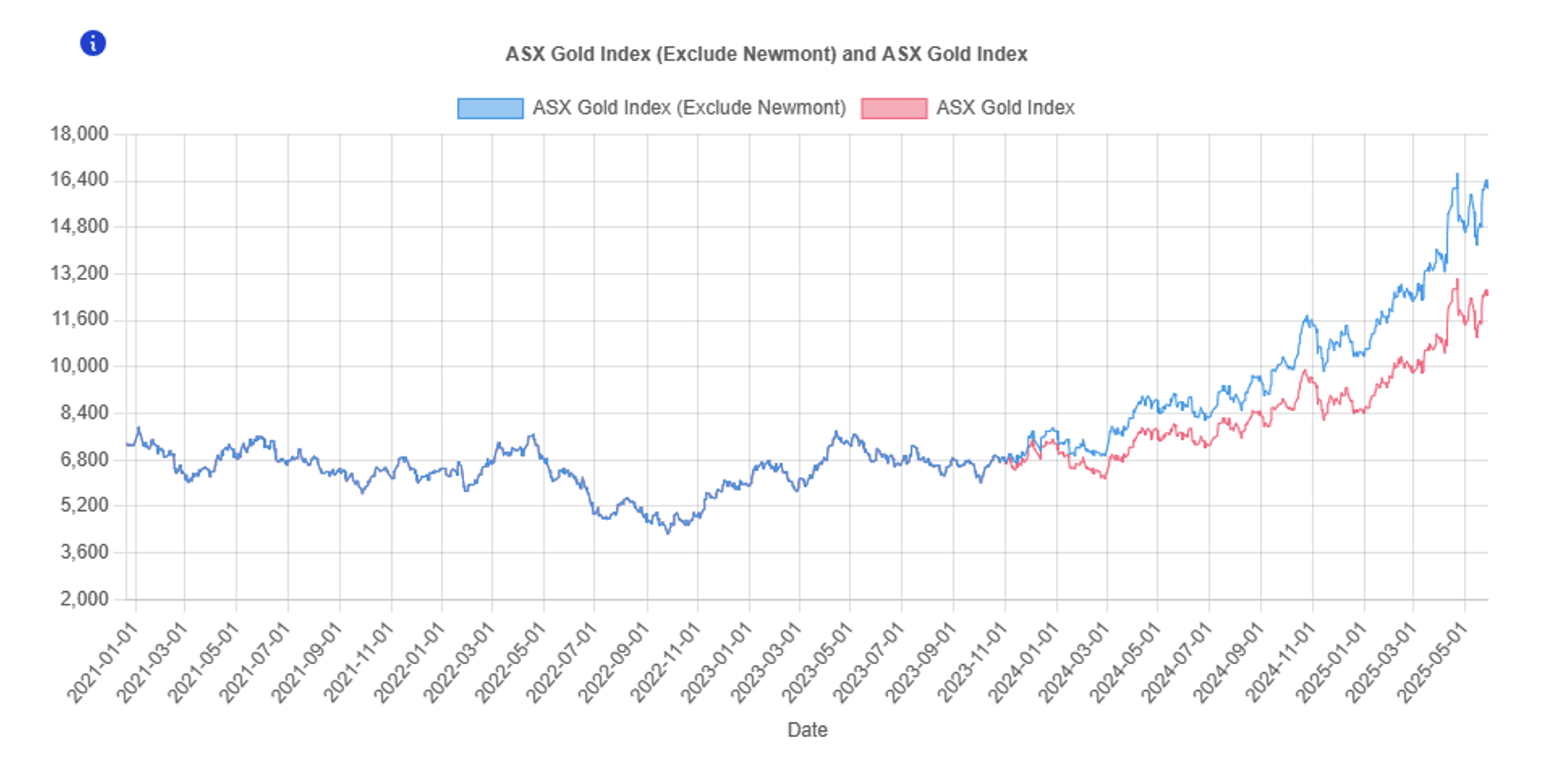

However, despite the slight correction in gold prices this week, the ASX All Ordinaries Gold Index has seen further upward developments this week, climbing up by 333.5 points since 26th May to 12,761.70 points. This is because many Australian gold mining companies have reported improved quarterly production results or provided forward bullish guidance. For example, as of May 2025, Ramelius Resources reaffirmed and upgraded its FY25 production guidance, projecting an output of 290,000 to 300,000 ounces of gold, up from its earlier forecast. This marks a notable increase from the previous fiscal year’s production levels. The company expects even stronger performance in the final quarter, underpinned by consistent output from high-grade operations. To add to that, Ramelius Resources have provided an AISC guidance of $1,550-$1,650 for the year, highlighting superior cost efficiency. Moreover, the broader risk sentiment on equity markets may have turned more favorable, prompting a reallocation back into resource stocks, particularly those seen as undervalued or with strong balance sheets. If investors believe that gold prices will remain elevated or rise again in the medium term due to macroeconomic uncertainty (such as inflation fears, geopolitical tensions, or potential rate cuts), this can lead to renewed buying in gold equities.

Figure 1: Movements in the ASX All Ordinaries Gold Index (Including and Excluding Newmont Corporation) (Source: GoldHub Australia)

Lastly, Meeka Metals (ASX:MEK) is on track to expect their first gold production shortly after June 2025. This is following news that confirmed Meeka Metals inching close to commission its refurbished processing plant at the Murchinson gold project in June 2025. Tim Davidson, Managing Director at Meeka Metals, also stated that the company has completed an expansion of its accommodation village to support increased mining activity. He further stated: “This expansion has now been completed, bringing capacity to 160 rooms and allowing us to operate the open pits and underground mines concurrently, getting more high-grade ore to the mill sooner. (This is) important in the context of grade streaming, processing flexibility and further expansion of processing capacity.” Meeka Metals currently trades at 0.14 AUD on the ASX, and has seen impressive jumps in their stock price, with a +107.14% increase in the last 6 months, and a +262.50% increase compared to a year ago.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.