Macroeconomic Indicators Drive Continued Bullish Momentum for Gold, however Fed Soon to Take Driver’s Seat

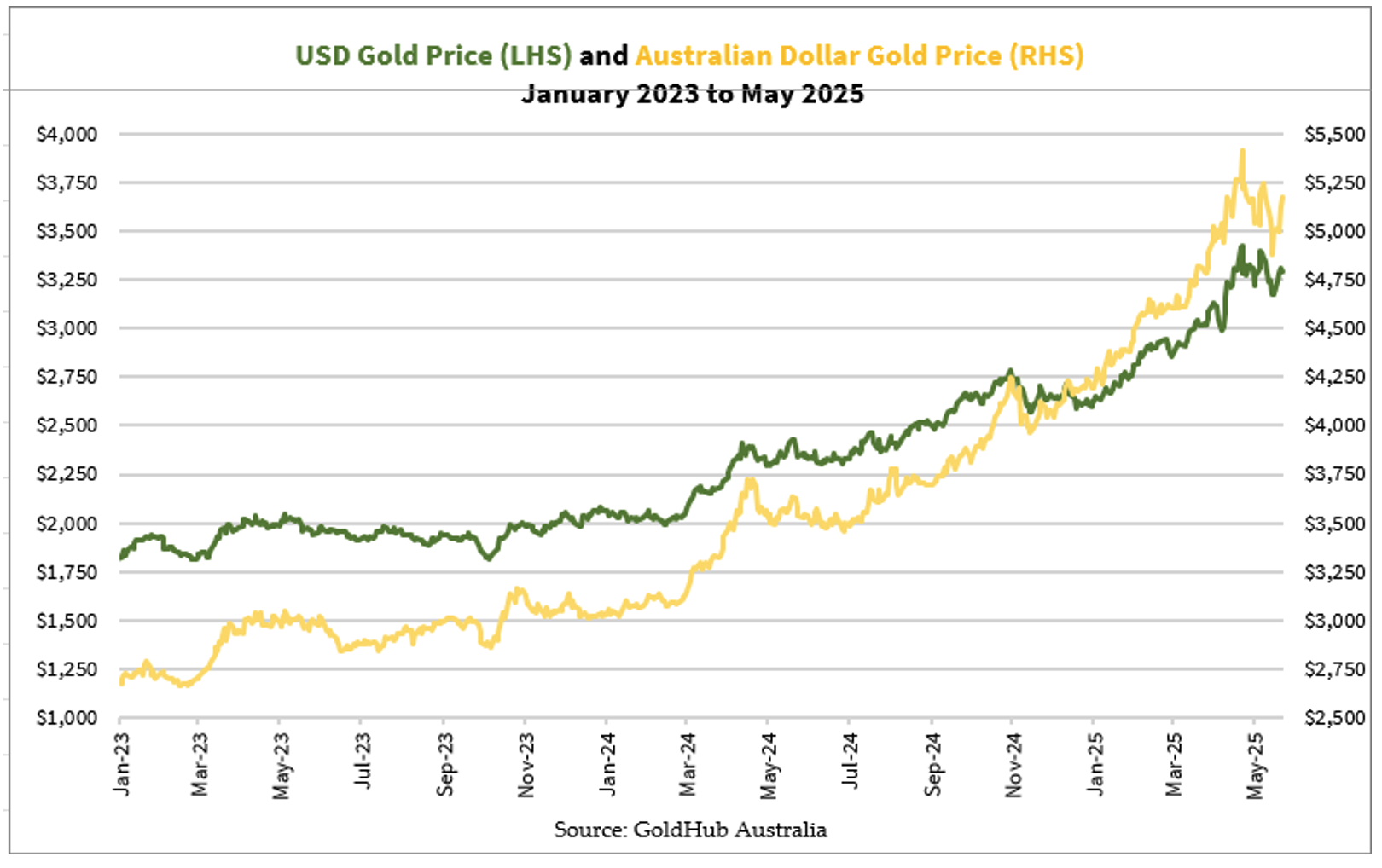

May 23, 2025This week, the prices of gold saw surges in both the U.S. and the Australian market. As of 22nd May 2025, spot gold in the U.S. was trading at US$3,289.4, up 1.67% since Monday. Meanwhile, as of 22nd May 2025, spot gold in Australia was trading at A$5,176.39, up 3.2% since Monday.

Figure 1: Gold Prices (USD, AUD) as of 22nd May 2025

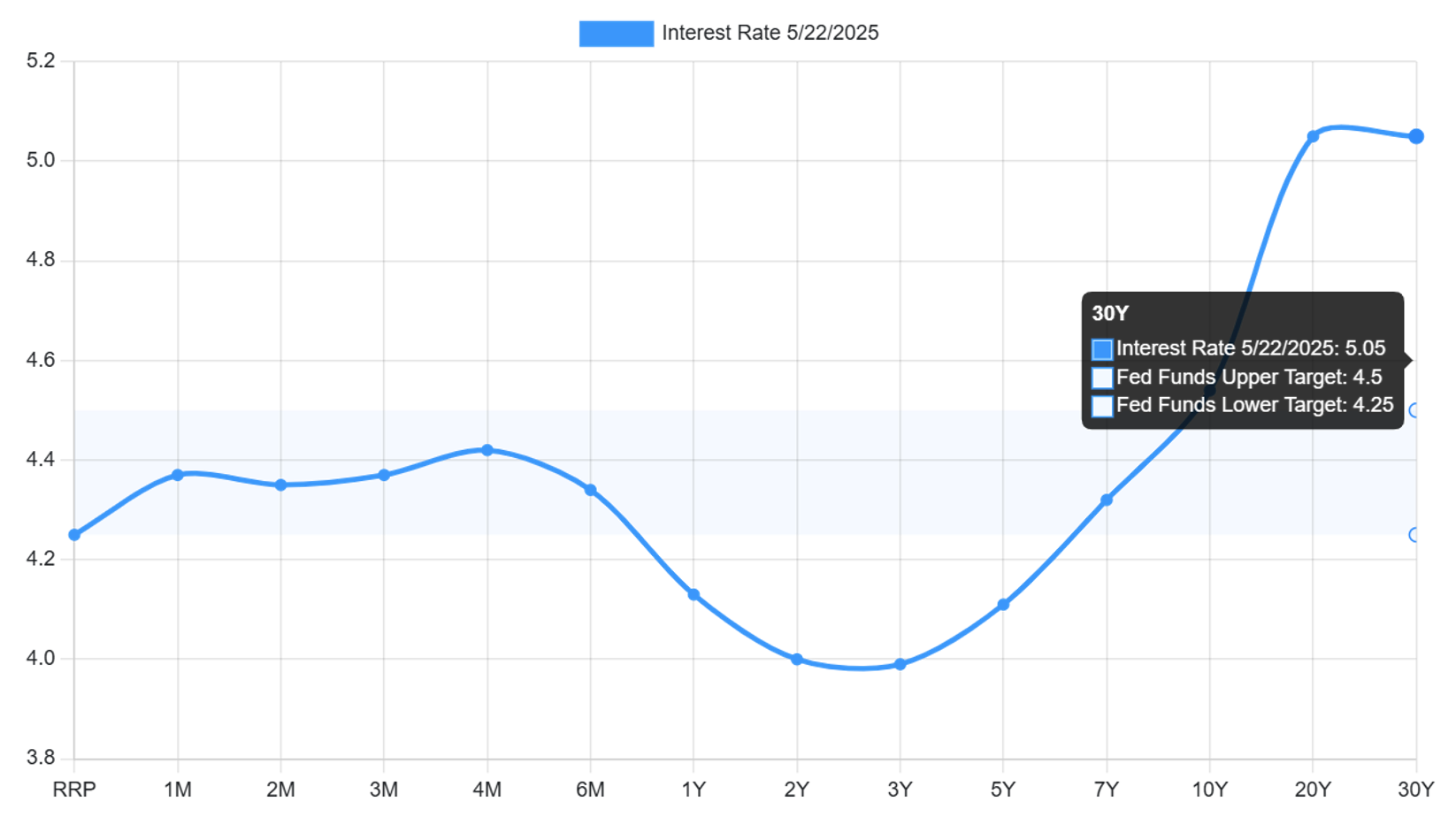

Considering the current environment, there are plenty of reasons to believe in gold’s bullish momentum to continue. The first reason is the bearish momentum in the bonds market, with rising treasury yields causing a shaky bond market. This resulted from poor investor reception in the U.S. Treasury 20-year bond auction on Wednesday, with 30-year bond yields in the U.S. surging to its highest since October 2023. Meanwhile, Japan’s 30-year bond yield reached a record high of 3.1872%. This bearish trend in bond markets is expected to continue, especially after the Fed expressed no intention of cutting rates in their June or July sessions. The second reason contributing to gold’s bullish momentum is reduced confidence in the credit markets. Moody’s, a globally renowned credit agency, stripped the U.S of its last remaining AAA rating last week. Jamie Dimon, CEO of J.P Morgan, commented on this situation by referring to the credit markets as a bad risk, and stated that investors are grossly overlooking the effects of inflation, stagflation and geopolitical risks to the global economy. According to Jordan Roy-Byrne, author of ‘Gold & Silver: The Greatest Bull Market Has Begun’, similar macroeconomic indicators were seen preceding the 1930, 1972 and 2002 gold bull markets.

However, despite the presence of macroeconomic indicators hinting towards a bullish momentum in the gold price, analysts expect a 10% drop in gold prices by the end of the year. These drivers include gold’s changing correlation to the real yield and the US dollar from negative to positive in recent months. Amidst easing geopolitical tensions and an improvement to global economic conditions, gold may pull back even if the Federal Reserve cuts the interest rate.

Figure 2: Yield Curve for US Treasury Bonds (1 month to 30 years)

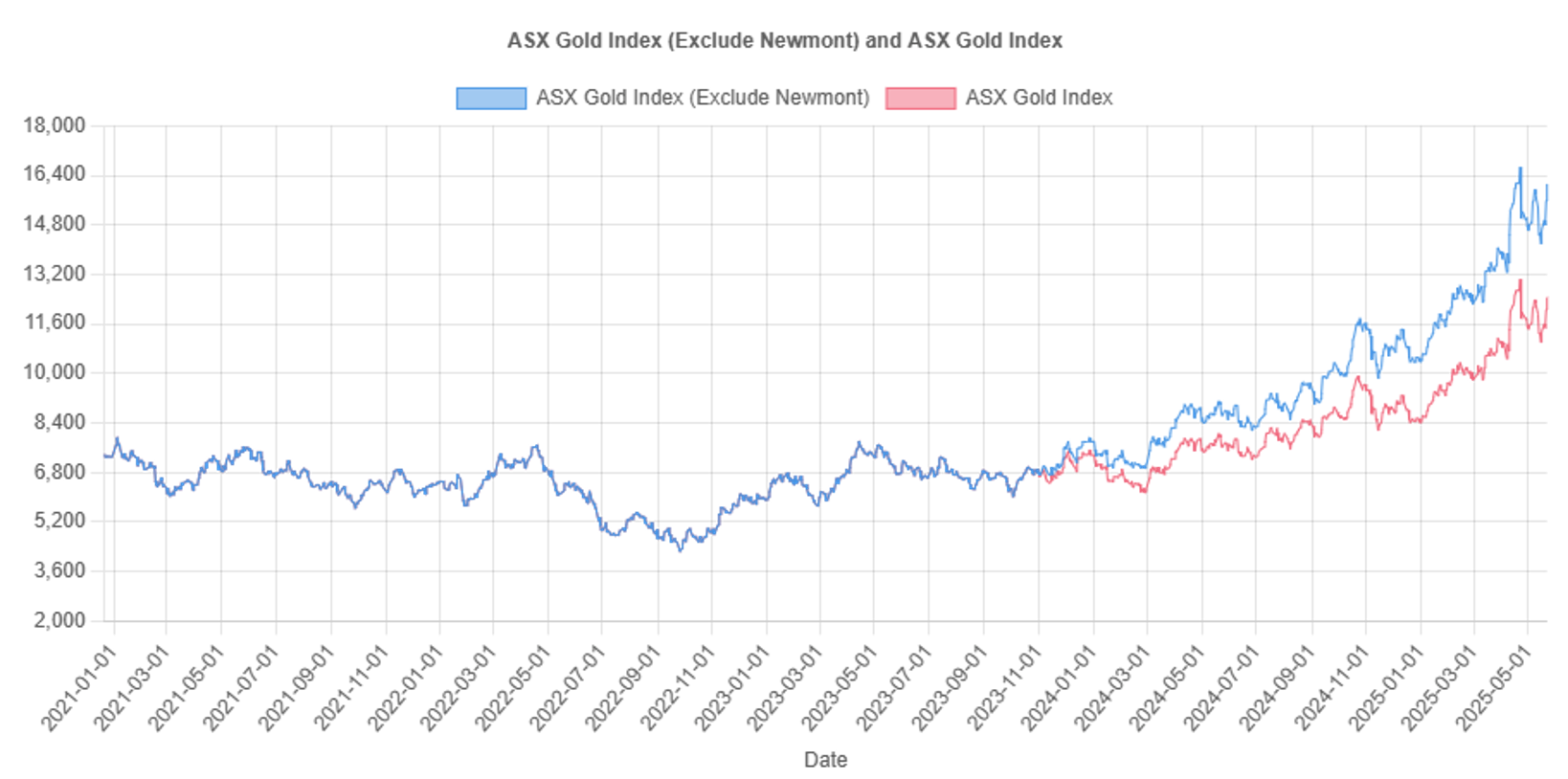

Moreover, the ASX All Ordinaries Gold Index rose by nearly 860 points on the 22nd May since Monday to 12,458.43 points. This move reflects gold’s bullish momentum, which could lead to enhanced profitability and revenues for Australian mining companies.

Figure 3: ASX All Ordinaries Gold Index Price Movements (Including and Excluding Newmont Corporation) (Source: GoldHub Australia)

Lastly, Kingston Resources (ASX:KSN) has entered into a binding definitive agreement with Ok Tedi Mining to sell its Misima Gold Project in Papua New Guinea for A$95 million. Kingston intends to use these funds to clear their debts worth A$15 million to Pure Asset Management. More importantly, the remaining funds will be used to expand exploration activities at the Mineral Hill Project, and develop overall copper production. The company will accelerate open-pit mining activities and conduct underground mining beginning 2026 across the Mineral Hill Project, to fulfill its six-year mine plan. The company’s stock price has surged 33.3% since last month to A$0.13.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.