Hitting the Crossroads: How Far can Gold Really Go?

May 20, 2025This week, gold prices remained relatively neutral in response to speculations of de-escalating geopolitical tensions, particularly with respect to the U.S potentially cooling things down with China. In the US, gold traded at US$3,336.84 an ounce before the market closed on Friday. This was a steep fall from Tuesday’s high above US$3,400 an ounce, but a 3% rise from last Friday’s price. In Australia, gold traded at A$5,174.24 before market close on Friday, with a similar pattern in movements compared to the US. Gold in Australia saw a sharp fall from Thursday’s price of nearly A$5,250 but was trading at 2% higher compared to last Friday.

Analysts are of the opinion that gold prices are expected to remain elevated, even though the upside now may be limited. This is because the support levels for gold have held strongly in recent times, despite parabolic investor sentiments in response to the changing intensities of global geopolitical tensions. However, gold’s neutral price movement this week was rooted in the Federal Reserve’s reiteration of their intention of being in no hurry to cut interest rates.This was in response to the U.S. economy maintaining relative stability and continuing inflationary scares. This in turn raises questions on the intensity of gold’s future bullish momentum, as analysts still reasonably expect rate cuts in July.

Furthermore, the only near-term risk for gold remains a de-escalation of tensions between U.S. and China with respect to their ongoing trade war. There is a growing sense of optimism that President Donald Trump and his administration will eventually end the trade war with China. The two nations are set to begin their negotiations this weekend, after President Trump announced an agreement with the U.K government of maintaining a 10% import tax on most U.K goods, and a roll-back on additional taxes imposed on strategic sectors such as cars and steel. If these speculations are realised, it wouldn’t be the most positive environment for gold in the short term as current support levels will potentially be tested.

Moreover, this overall net-positive current sentiment with respect to gold this week, coupled with increased central bank purchasing in recent times, has led to the ASX-All Ordinaries Gold Index to increase by nearly 700 points to 12,302 points. Investors could benefit from this net-positive sentiment and gold’s bull run through investing in gold mining equities listed on the ASX All-Ordinaries Gold Index. Gold’s bull run in recent times has seen the ASX-All Ordinaries Gold Index breaking record after record and reaching new all-time highs frequently. This is a reflection of the strong, disproportionate operating leverage that precious metals and mining companies see during bull runs, which is a call to action for savvy investors.

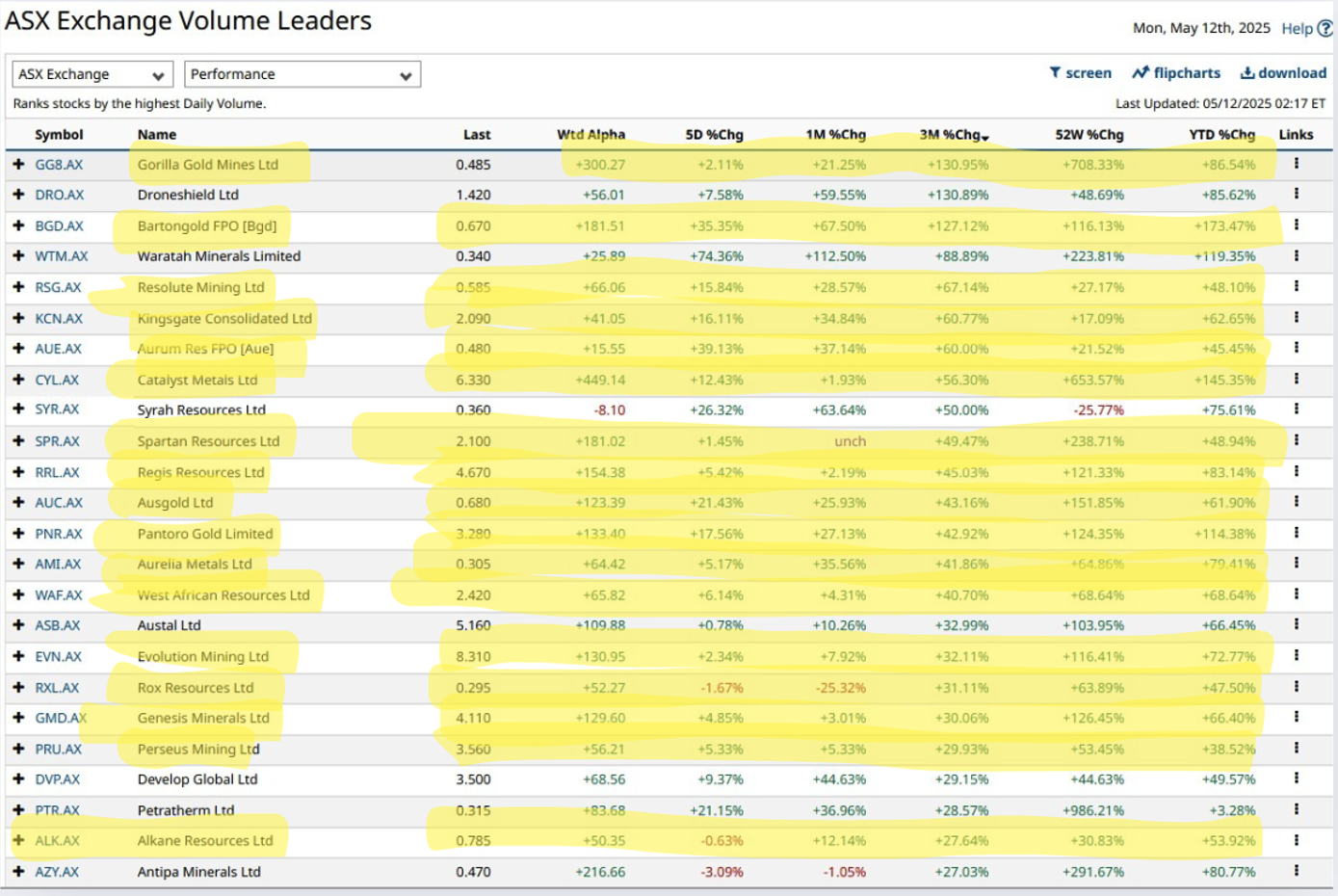

Figure 1: Stock Price Movements among Gold Producer’s (5D, 1M, 3M, 52wk and YTD)

As an example, in the last 3 months, several gold producers have been benefiting from gold’s bullish momentum, with average gains for many producers ranging from 34% to 135%. West African Resources (WAF:ASX) has risen 42.61% in the last 3 months. WAF is a company known for maintaining low costs and significant operating margins. With gold’s bull run, WAF has advantaged significantly. The company has seen higher margins and further exploration activities boosting their stock prices significantly. Usually, a significant bull run results in greater operating leverage and margins with companies, coupled with an increased probability of further exploration activities. It is during this period where investor sentiment peaks positively and one where investors should leverage the upside offered by disproportionate operational leverage seen by mining companies. However, investors should now consider a ‘wait-and-see’ phase. With gold’s price coming under scrutiny with optimism around de-escalation of trade wars and easing macroeconomic pressures, gold prices may see a slight correction coming into the future. However, this doesn’t mean investors won’t be able to leverage upside in mining equities anymore. The effects of the current bull run on mining companies are here to stay for the short-term, and investor focus should be on company fundamentals and exploration potential, coupled with a strict watch on the macroeconomic environment. Nevertheless, positive sentiments from analysts, suggesting gold won’t fall way below their current support levels is positive for mining equities investors. Investors will be able to continue to enjoy the operating leverage of the mining companies and make considerable gains. The only question is: For how long will gold continue to stay its stellar run?

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.