Valuing gold stocks: The Australian Gold Fund difference

May 5, 2025How much is a gold mining company worth?

That’s the billion dollar question many investors ask.

Can you apply to same valuation method for all gold mining companies?

Perhaps we can use Benjamin Graham’s approach to calculate the intrinsic value of the company based on its assets and future cashflow generating potential.

In theory, that’s easy to say. In reality, it’s more complicated than you think.

I could discuss the differences between a gold producer (a company currently mining and selling gold), a gold developer (a company that has an advanced deposit it is bringing to production), and a gold explorer (a company that is searching for a deposit or has an undeveloped deposit), and how you have to use different metrics to value them. But you’d end up reading a chapter rather than an article.

Let me talk briefly about valuing gold producers to avoid taking an hour or two of your time. After all, these are the most traded companies in the gold stock space. If you identify a few nifty pointers about how to invest in these companies, the potential rewards can be handsome. You can venture into the earlier-stage companies once you get a knack for investing in gold producers.

And yes, as you proceed down the hierarchy of gold mining companies, the risks are greater, but so is the potential reward. But before you venture into the deep ocean, ensure you can swim properly in less treacherous waters!

Let us first understand how to value a gold producer. These companies own at least one mine producing gold (and other metals). In these mines are gold deposits, facilities to crush the ore and extract the gold from the ore, equipment and vehicles, and staff running the business. It generates revenue from selling gold and other metals and incurs expenses from salaries/wages, processing/mining, corporate overheads, fuel and chemicals, supplies, and taxes.

Typically, you value a company based on its future profit potential. You don’t pay for the past profits; that’s behind you. You may use recent results as a basis for your forecasts.

With mining companies, I have learnt that cashflows matter. In other words, how much cash surplus does the company deliver?

If you have studied finance, this makes sense to you. A company’s value is its ability to generate future cashflows, with cashflows earned closer to today being worth more because of the time value of money. Accounting profit is of secondary importance.

So what does that mean for valuing gold producers?

Instead of calculating the company’s profit and comparing it to the current market value to compute the Price-Earnings Ratio, I focus on how much surplus cash the producer generates to extract and sell the gold.

What I like about mining company financial reports is that they will present a wide range of operating metrics including the volume of gold produced and sold, the per-unit cost of production (the key cost is the all-in sustaining cost), the volume of ore mined and processed, and the ore grade/recovery rates. All these show me not only how profitable the mine operation is, but also the efficiency in each step of the mining process.

You won’t get that with other companies like Commonwealth Bank, Woolworths, Telstra, etc. These companies don’t report the number of customers, the average revenue generated from each product/service, or the margin generated in each line of business, etc. They’ll report the aggregate revenues, expenses, profits, and other figures.

Getting back to gold producers, I developed my own valuation metric to help me compare them. It’s quite simple and intuitive. I’ll briefly explain how it works. It is a bit technical but hopefully not too complicated.

I take the company’s market value and subtract its cash balance (or add outstanding debt), which gives me the current value of the business. That’s what the market currently pays for the company.

Next, I calculate how much gold the company produces annually and divide it by its all-in sustaining cost, with an adjustment factor. I incorporate the production cost rather than just take the amount of gold produced because I want to give a favourable weighting to lower cost producers as it’s better to own a producer operating for lower costs because it can generate better margins. I call this the AISC-adjusted annual production.

We’re almost there. Just one more step.

Finally, I want to know how much surplus the producer can earn from selling its gold. This allows me to calculate a cashflow equivalent of earnings. So I take the realised sale price and subtract it by the all-in-sustaining cost to give me a per-unit cash surplus.

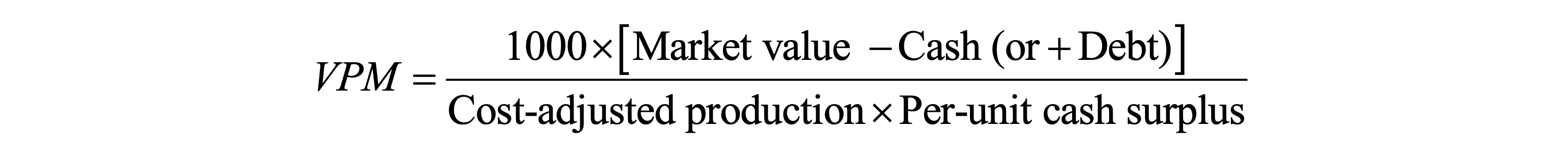

Now let’s put this together. I call my valuation metric the Value to Profit Margin Multiple. This is the formula:

Figure 1: Value to Profit Margin Multiple

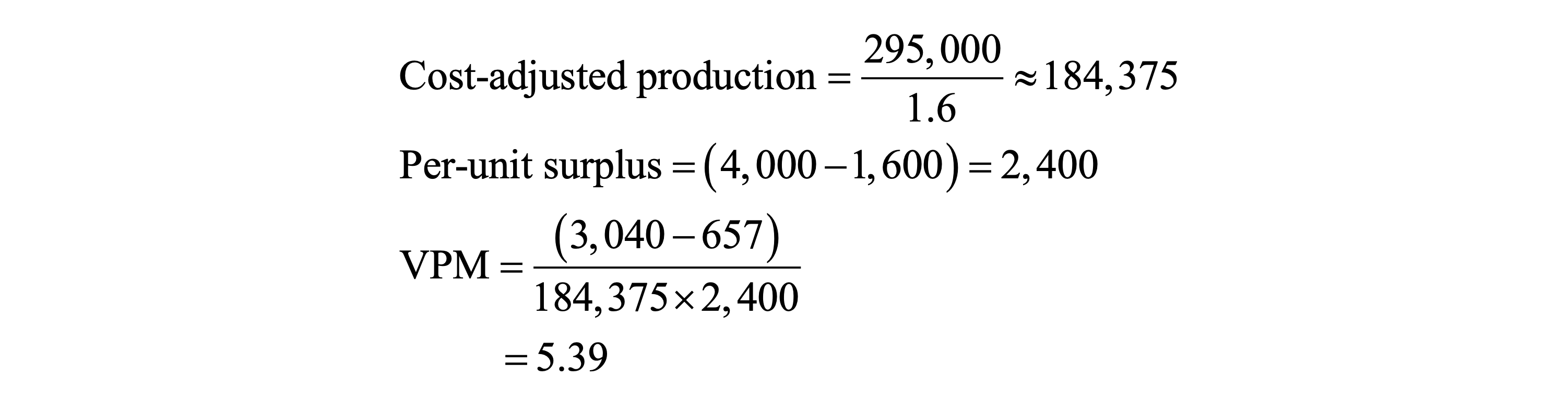

To illustrate how it works, I’ll use Ramelius Resources, a mid-tier gold producer. It closed at $2.62 on the 5th May, with a market value of $3.04 billion. The cash balance is $657 million, with no debt. The company expects to produce around 295,000 ounces of gold for this year at an all-in sustaining cost of $1,600 an ounce. I estimate that the average realised price of gold over the year will be $4,000 an ounce.

Therefore, the calculation is as follows (expressing market value and cash balance in millions of dollars):

Figure 2: Example of Calculation to Value to Profit Margin Multiple

So that’s the multiple. What does it mean?

This tells you that you are paying $5.39 for every cost-adjusted surplus generated by each ounce of gold. This is the cashflow-equivalent of the PE ratio.

As it stands, the ratio doesn’t mean much. We can use this to compare gold producers against their past performance and against each other. But there is more to it than that, which I won’t go into detail here. You can learn more about it in my newsletter service that I work with Fat Tail Investment Research to provide. For more information, you can check out this video.

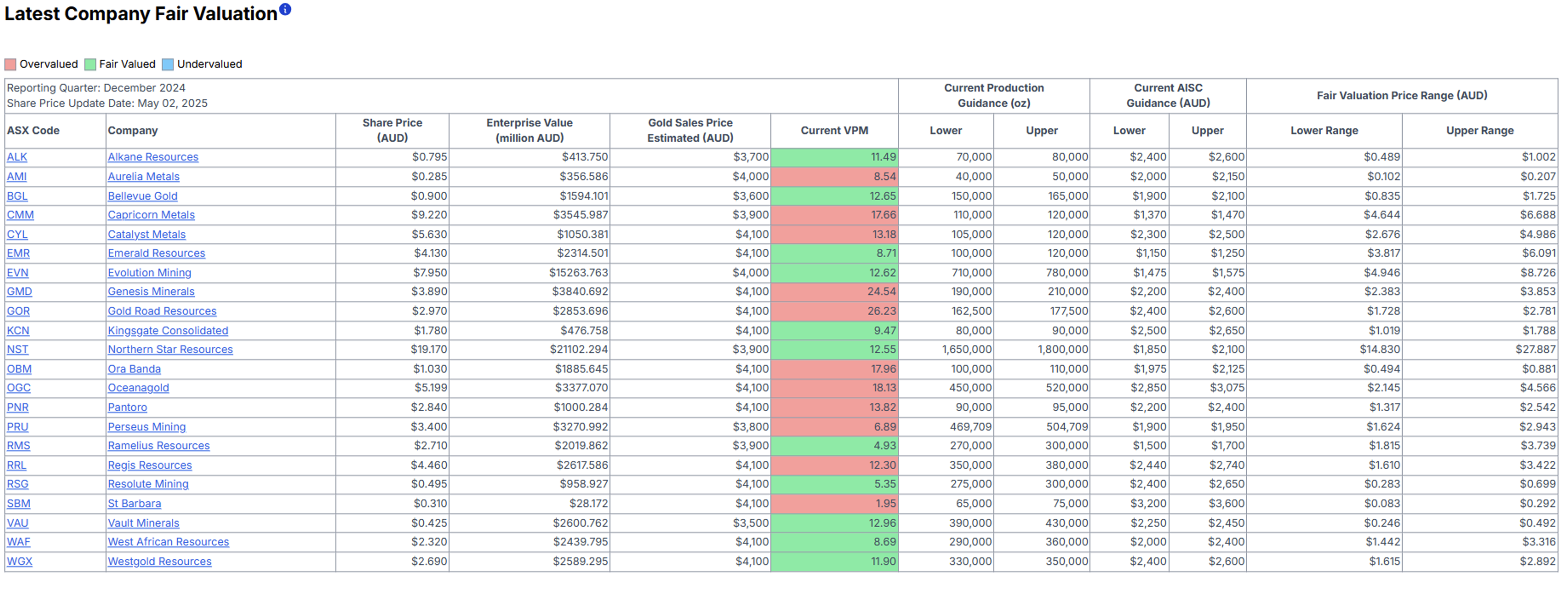

If you found the mathematics too difficult, don’t worry. We do the hard work for you. We collect the data, perform the calculations, and give you the results:

Figure 3: GoldHub Australia VPM valuations table

You can use these for your analysis to inform your trading.

If you like what you’ve read, why not sign up to our mailing list and take a free trial of our data provider service?

That’s it from me for now. Stay tuned for more useful insights.

God bless.

For a limited time, you can use the promo code PULLBACK25 to get 50% off the first year of subscription.

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.