US Dollar Outlook Bearish – Is Cash still King?

May 3, 2025There is a well-known saying that "Cash is King". Indeed cash has proven to be a good refuge when there is market turmoil, like when Covid-19 hit the financial markets and when the rate rises in 2022-23 threatened to quash the animal spirits that had taken over since central banks pushed rates to 0% and governments unleashed what seemed like an unlimited amount of funds with their stimulus packages.

However, all this seemed to have changed recently after US President Donald J. Trump took back the White House and implemented tariffs as part of the administration’s “America First” agenda.

But let’s take a step back and look at what is cash and understand how our financial system is not what we think it is.

For many decades, we live in an imaginary world where central banks implement monetary policy to control inflation and economic activity. Fiat currency, or what we mistakenly call “money”, drives daily global trade. But this currency can be printed in unlimited quantities to achieve the purposes of policymakers under sophisticated terms such as "expansion monetary policy" or "inflation control". When the economy is weak or businesses and consumers lack confidence, the central banks lower the interest rate and governments increase spending to attempt to spur the economy, and vice versa. In turn, these funds flow into or drain from the economy and financial markets.

It sounds like a nifty thing. You can pull a few levers, press a few buttons and the economy will behave itself. Not quite!

Given the volatile economic and market conditions in the last five years, we have come to realise that the economy and financial markets are much more complicated. And the more interventions we see, the more we experience unintended consequences.

Moreover, today we’re sailing into uncharted territory, thanks to the economic policies of the Trump administration and how the world has reacted since.

Going back to the original statement about “cash is king”, what I’m seeing is that maybe this is no longer holding. Let me show you how the US Dollar Index has performed recently:

Figure 1: Pessimistic setup of DXY (USD Value)

To provide context, the U.S. Dollar Index (DXY) is a measure of the value of the United States dollar relative to a weighted basket of six major world currencies. Essentially, it gauges the value of cash, as the US dollar is the reserve currency, or a defacto monetary standard. As you can see, the dollar was on a bullish run from 2014 to 2017. This came as the US Federal Reserve steered the global economy out of the zero-interest rate policy era after the subprime crisis of 2007-09. The second bull market for the dollar occurred in 2022-23 when the US Federal Reserve again raised interest rates, this time at the fastest pace in several decades.

But since 2023, the DXY fell and traded sideways as the US economy hobbled along, weighed down by slowing business activity and rising unemployment and inflation.

With President Trump returning to office, the DXY took another tumbling, driven by the following factors”

-

President Trump has consistently expressed his preference for a weaker dollar, as this enhances the competitiveness of U.S. exports and reduces the trade deficit. A weaker dollar makes U.S. goods cheaper for foreign buyers, theoretically boosting demand. It aligns with his "America First" agenda. However, this stance breaks with traditional U.S. policy. This agenda has by far the biggest impact on the US dollar’s outlook.

-

What if you are not holding USD? While a depreciating USD does exert upward pressure on the relative value of other currencies within the DXY basket, the relationship is not a zero-sum dynamic. Despite the DXY experiencing an approximate 10% year-to-date (YTD) decline, as indicated by the data provided, not all major currencies have registered a corresponding equivalent gain of 10%. The table below illustrates this point:

| Currency | Symbol | Estimated YTD Performance vs. USD |

|---|---|---|

| Euro | EUR | +5-6% |

| Japanese Yen | JPY | -0-1% |

| British Pound Sterling | GBP | +6-7% |

| Canadian Dollar | CAD | -1-2% |

| Swiss Franc | CHF | +10-11% |

| Australian Dollar | AUD | <0% |

| New Zealand Dollar | NZD | <0% |

This happens because the money flows into investment assets and the slower economies, which lead to the limited demand for holding cash. This doesn't even consider inflation caused by an increased money supply. This suggests that holding cash might not be a good idea in the medium term.

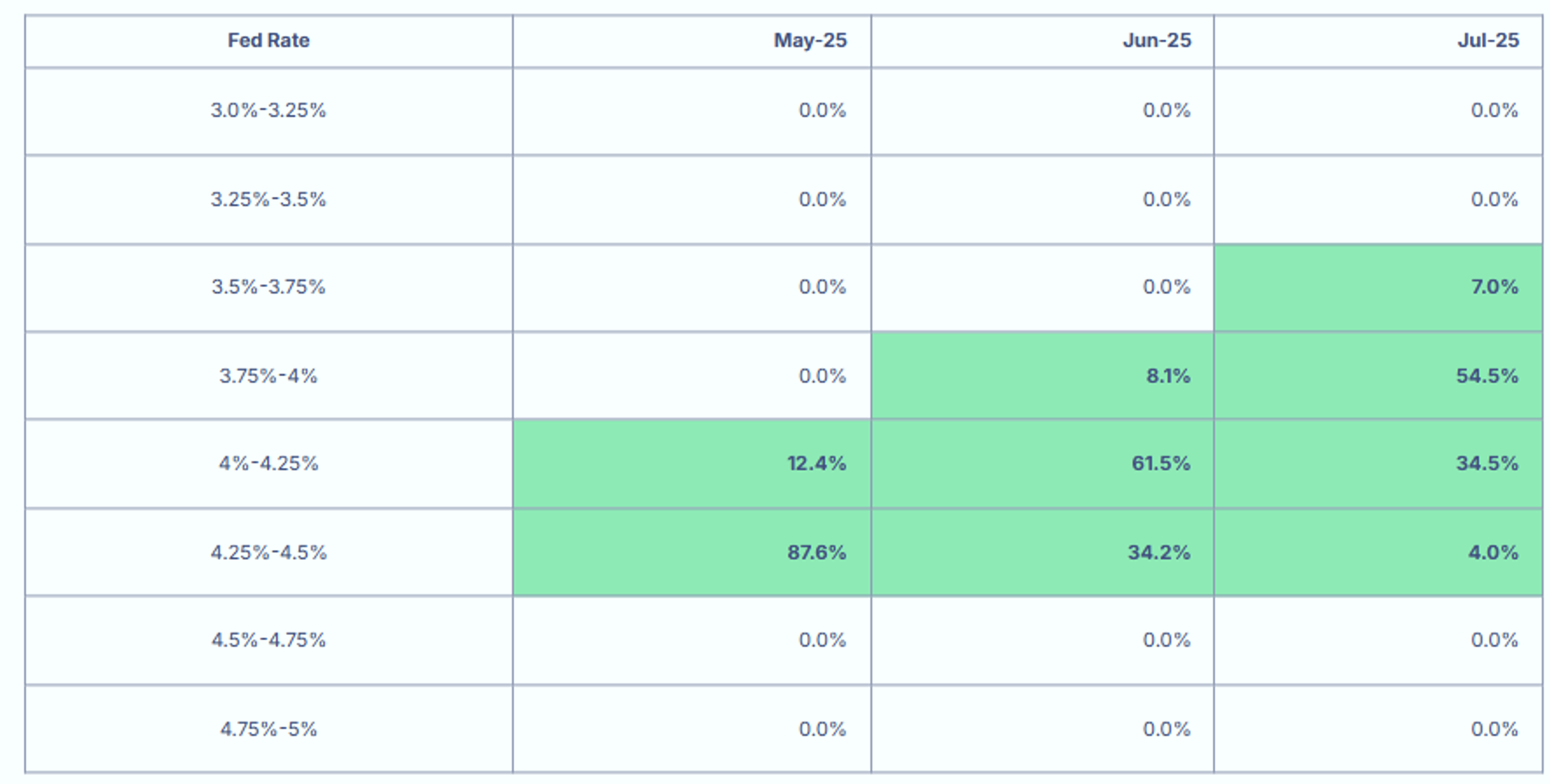

We can see the evidence of falling confidence in USD in the dramatic sell-off of US bonds. Bond price drops significantly, which reflect investor apprehension regarding the sustainability of the USD's value, particularly given the stated preference for a weaker dollar by the U.S. The picture in the medium term for USD is not even bright when the market projects 3 rate cuts in 2025. Should ongoing uncertainties with international trade persist, the markets may anticipate the US Federal Reserve to bow to the pressure to cut the Federal Funds Rate. This could intensify the US dollars weakness and push the DXY down further. Given gold has performed strongly in the past three years, it appears that the market has pushed out the US dollar as a joint safe haven asset with gold.

Figure 2: FED rate probability (Source: GoldHub Australia)

As you can see gold prices are likely to experience substantial support. Projections from Goldhub, suggesting target price ranges of $3,500-$3,800 for late 2025 and beyond, often implicitly incorporate the assumption of a relatively soft dollar environment.

Furthermore, underlying structural factors, including persistent geopolitical instability and consistent central bank demand for gold, are expected to help the price of gold remain strong. These factors would likely mitigate the extent of any potential price correction stemming solely from a strengthening of the dollar.

Moreover, these factors may offset the traditional relationship between gold and the US dollar, which usually moves in opposite directions. We may see both gold and the US dollar rise under such unusual conditions.

Stay tuned!

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.