Gold stocks plunge heavily, but experts call this a correction than a change in trend - Weekly Market Wrap-Up (21st-25th April 2025)

April 27, 2025This week on Tuesday, gold prices saw an all time-high, reaching US$3,426 and A$5,412.47 respectively. However, prices dropped by ~4.5% by market close on Friday, with gold prices in the U.S. at US$3,272.5 and A$5,181.64 in Australia. However, this fall in prices is largely only being credited to profit-taking, despite a slight increase in interest in the U.S. Dollar and bond yields, with the U.S. Dollar slowly climbing back to 100 points, standing at 99.471 as of 25th April.

Figure 1: US Bond Yield (Source: GoldHub Australia)

Figure 2: Slight rise of DXY

Currently, the consensus among analysts is that Tuesday’s high isn’t supposed to be the high for the remainder of the year, with a drop in prices post-Tuesday only being a healthy pullback. Additionally, the renewed selling pressure in gold may have come due to easing fears over the global economic situation, though the uncertainty still remains high enough to support current gold price levels. While President Trump claims his administration has begun trade talks with China, the Chinese Government has denied any such happening. The economic headwind lies in expected rising inflation in the short term, which turn to be short-term catalyst for gold.

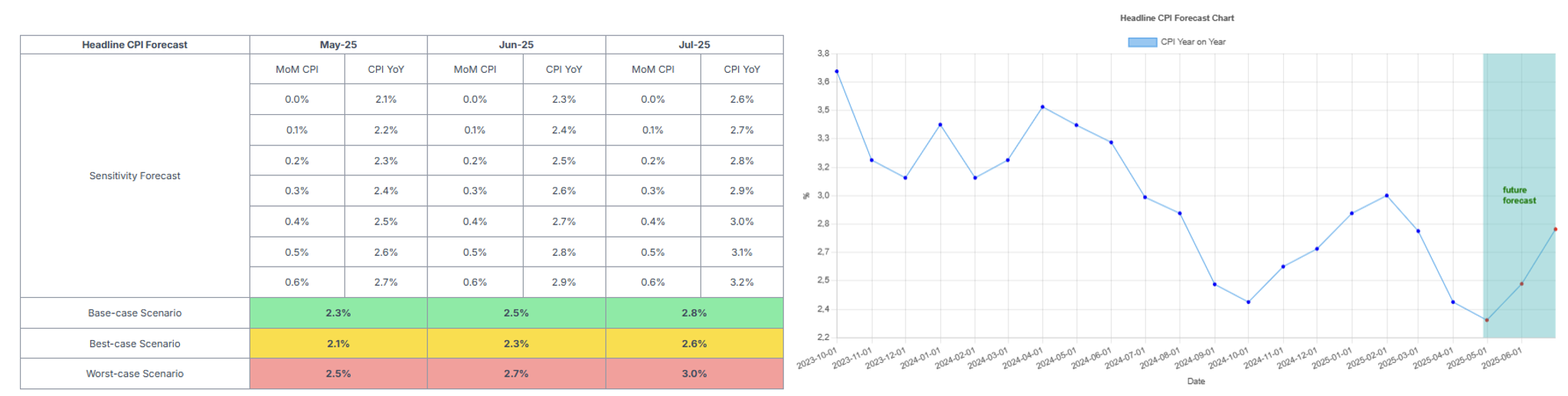

Figure 3: Goldhub’s Projection of Headline Inflation (Source: GoldHub Australia)

Kelvin Wong, Senior Market Analyst at OANDA, doesn’t believe that gold’s rally is over. He believes that the risk of greater uncertainty in business planning and stagflation in the U.S. will increase if there are no breakthroughs between the U.S.-China trade negotiations and if more U.S. sector based tariffs are introduced, which in-turn would lead to a weaker U.S.

A similar dipping pattern was noticed in the ASX All Ordinaries Gold Index this week, with the index hitting an all-time high of 13,046 points on Tuesday, taking a sharp dip and falling to 11,961 points on Thursday, due to increasing selling pressures in gold due to temporary easing fears around economic uncertainty.

Finally, Capricorn Metals [ASX: CMM] saw a sharp drop in their stock price on Wednesday (-11.4%), following the announcement of their CEO Paul Criddle’s charge for aggravated assault over an incident back in March. However, the company stated that despite Criddle being relieved of his position, the management and executive functions of Capricorn Metals are well covered with Executive Chairman Mark Clark continuing in his full time leadership role together with the broader strengthening of the executive team announced December last year. On the contrary, the company has recently acquired the Ninghan Gold Project for $1.6 million, having already paid a cash deposit of $100,000. The project features multiple settings conducive to hosting economic gold deposits, making it highly prospective for gold mineralisation, and will help identify production targets for the company for the remainder of the year. Also otherwise, the company saw another strong quarter of operations, and are in-line to achieving their guidance of 110,000 - 120,000 ounces for FY25. Overall, Capricorn Metals has seen a stock price increase of ~50% year-to-date, and ~90% since last April, owing to significant increase in profitability, increasing operational efficiency and a consistent revenue growth trajectory.